Rumors that the Bank of Japan will make adjustments to the monetary policy at its meeting in late July and served a good yen. The USD / JPY pair fell to a two-week low, competent source information from Bloomberg and Reuters who wanted to remain anonymous about more flexible management of the yield curve and about changing the technical nuances of buying bonds and specialized exchange funds within the quantitative easing program. Yield of 10-year bonds of the Land of the Rising Sun took off at the fastest pace in almost two years, BoJ was forced to enter the market with an offer for unlimited purchases of assets and to excuse Haruhiko Kuroda, himself, from Buenos Aires. According to the Governor of the Central Bank, there is no such thing as yet. Is it so or smoke without fire did not happen?

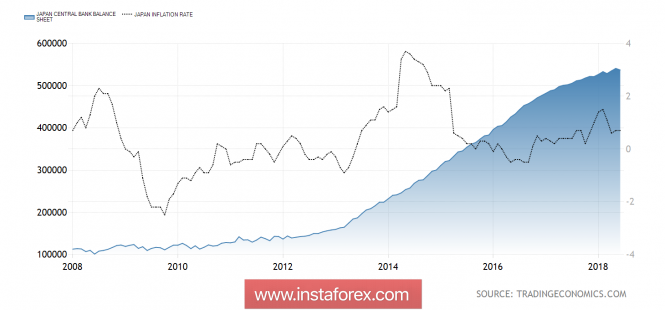

When you are stuffing the economy for a long time with cheap money within QE, and then you also enter control over the yield curve, the result is still not there. The question arises: are you able to achieve it? Or will others do it for you? Factors such as the aging of the population, its deflationary thinking and new technologies limit the growth potential of inflation. Large-scale purchases of assets do not bring benefits. Moreover, the growth of the balance is slowing down, since the figure of 80 trillion yen, in fact, has become a story. The actual amount of bonds purchased and ETF is almost twice as large. This is quite enough to keep rates on 10-year debt obligations near zero.

Dynamics of inflation and balance of the Bank of Japan

One of the factors is the strong yen where there is persistent reluctance of consumer prices to move in the direction of targeting at 2%. Over the past three years, it has strengthened against the US dollar by 10%, and competes with the "American" for the title of the best performer of the year among the G10 currencies in 2018. The fall in the value of imports and producer prices limits the potential for CPI growth and creates a serious headache for the Bank of Japan. He cannot allow a repeat of the 2017 history with the euro, which grew due to rumors about the normalization of the ECB monetary policy. On the contrary, BoJ should think about how to make politics even milder than now, which is an extremely difficult task.

At the same time, the verbal intervention of Donald Trump who is dissatisfied with the Fed's raising of the federal funds rate and the strengthening of the US dollar which is helping to lower the USD / JPY quotations. The tightening of monetary policy by the Federal Reserve and the rapid growth of the US economy contributed to the analysis of a pair of 6-month highs analyzed. I do not think that bulls will be able to develop their attack by the yen even before the release of the US GDP data for the second quarter. Investors put the quotation of the pair with possible growth of the US economy by 4% q / q and above, which will extend a helping hand to the dollar's fans and, most likely, will result in the consolidation of USD / JPY pair.

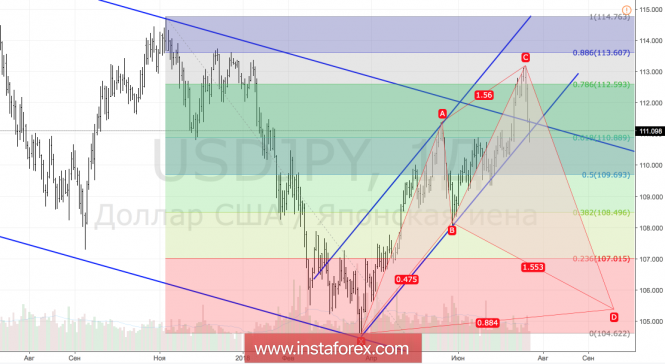

Technically, only a confident breakthrough of support at 109.1 and 108.5 will allow the "bears" to activate the "Shark" pattern and move towards its target by 88.6%.

USD / JPY, daily chart