The euro continued to confidently restore its positions against the US dollar against the backdrop of statements made by the US president on Friday, as well as comments from representatives of the Federal Reserve System.

Traders reacted through short positions on the US dollar and purchases of risky assets after US President Donald Trump on Twitter spoke out against the EU and China. Trump believes that China and the European Union are engaged in manipulating the national currency and interest rates, while in the US, they are moving in a different way. According to the US president, China and the euro zone are plundering the US, depriving them of a great competitive advantage.

On Friday, the head of the Federal Reserve Bank of St. Louis also expressed concerns about the excessive interest in raising interest rates on the part of the Fed, which was observed this year.

James Bullard reiterated his appeal and called for a halt to the rate hike, as further tightening of the policy could lead to the inversion of the yield curve.

Bullard also said that he was not surprised by Trump's speech, which was attacked with criticism of the Fed's policy. However, in his opinion, the committee remains an independent body and Trump can influence it only by appointing new leaders. At the end of the speech, the representative of the Federal Reserve noted once again hat the Fed is very good at fulfilling its tasks in the form of maintaining price stability and maximum employment.

As for the technical picture of the EUR/USD pair, the demand for the euro will continue, but only after the break and consolidation above the large range of 1.1745-1.1750, which will open a direct road to a large resistance of 1.1790, and then return to the highs of June this year in the area of 1.1850 and 1.1890. If the demand on the range of 1.1745-1.1750 is not present again, the pressure on the euro may significantly increase that may lead to a correction in the area of 1.1670 and 1.1600.

The Canadian dollar against the US dollar also increased significantly on Friday after a good inflation report, which in June reached a maximum in more than six years. The main reason for the growth was high energy prices.

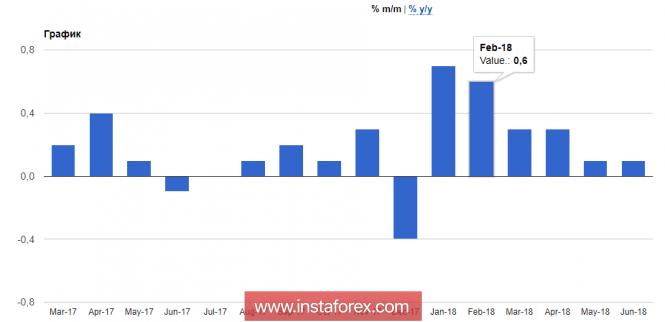

According to the data, the general consumer price index of Canada increased by 2.5% in June compared to the same period last year, after an annual growth of 2.2% in May. Economists expected that annual inflation would grow by 2.3%. Compared to May, the consumer price index of Canada showed an increase of 0.1%.

Also in May, retail sales increased substantially. According to the National Bureau of Statistics of Canada, retail sales rose by 2% in May compared with April and amounted to 50.76 billion Canadian dollars, while economists expected growth of only 1%.

The material has been provided by InstaForex Company - www.instaforex.com