The US dollar has seriously strengthened its positions against the European currency and the British pound amid the tensions created by the effects of growing trade tensions between the US and China. Let me remind you that yesterday the White House announced new trade duties on a number of goods from China, which immediately provoked Beijing's response measures.

The data released on Wednesday in the afternoon, slightly affected the quotes of the US dollar.

According to the report of the US Department of Commerce, wholesale companies in the United States resumed their stocks at a faster rate in May. So, inventories in wholesale trade grew by 0.6% compared to the previous month, while economists expected that stocks would grow only by 0.5%. Sales in wholesale trade in May grew by 11.8% compared to the same period of the previous year.

The speech of the representative of the Federal Reserve Bank of Williams also did not affect the markets. He mainly talked about the use of borrowed funds in the US financial system, as well as the problems of American employers who are faced with the search for qualified specialists.

As for the technical picture of the EURUSD pair, going beyond the support level 1.1680 could seriously affect the further upside potential in the pair. An unsuccessful attempt to return to this range today will form a larger downward trend, which will lead to new lows of 1.1650 and 1.1590.

Quotes of oil fell sharply yesterday after news that Saudi Arabia unilaterally increased its oil production in June this year, without waiting for OPEC's main decision, as well as news about the resumption of oil exports from eastern ports of Libya, which could ease concerns about the deficit of the world supply.

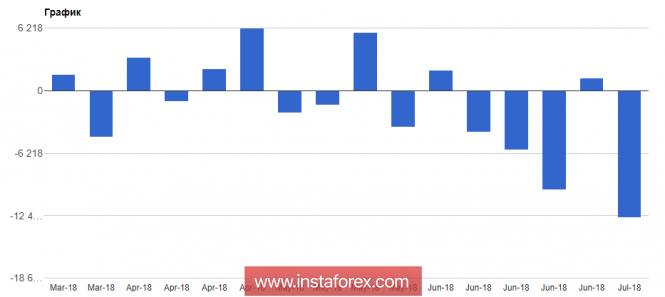

It did not help black gold and a report from the US Department of Energy on stock reduction. According to the data, commercial oil reserves in the US for the week from June 30 to July 6 fell much more than analysts predicted.

Thus, oil reserves fell by 12.6 million barrels, to 405.2 million barrels, while analysts assumed a decrease in reserves of 3.6 million barrels. Gasoline inventories declined by 700,000 barrels, to 239 million barrels, and distillate stocks rose 4.1 million barrels, to 121.7 million barrels. The loading of oil refining capacities decreased by 0.4 percentage points, to 96.7%, while economists expected that this index would decrease by 0.1 percentage points.

The material has been provided by InstaForex Company - www.instaforex.com