Dear colleagues.

The currency pair EUR / USD continue to move downwards after the breakdown of 1.1652 and the level of 1.1712 is the key support. For Pound / Dollar pair, we expect the breakdown of 1.3190 for the subsequent development of the downward movement. For the pair Dollar / Franc, we expect the price to move to the level of 0.9986. For the pair Dollar / Yen, the continuation of the development of the upward structure from July 9, we expect after the breakdown of 112.38. For a pair of Euro / Yen, the price forms a local structure for the upward movement of July 11. For the Pound / Yen pair, we follow the formation of the local structure for the top of July 9th.

The forecast for July 12:

Analytical review of currency pairs in the scale of H1:

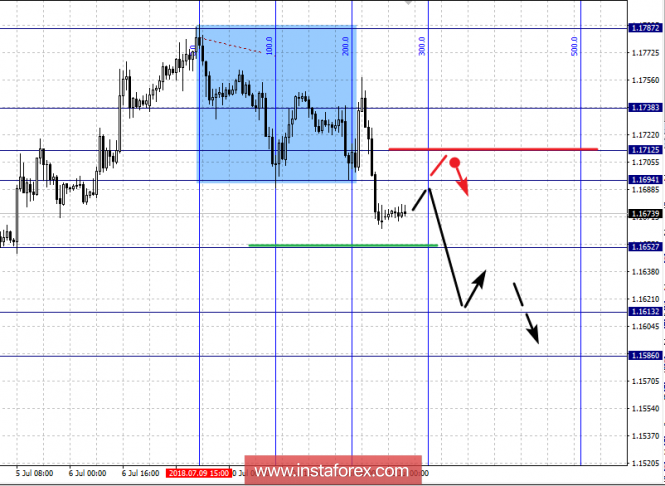

For the EUR / USD pair, the key levels on the scale of H1 are: 1.1738, 1.1712, 1.1694, 1.1652, 1.1613 and 1.1586. Here, we follow the development of the downward structure of July 9. The continued downward movement is expected after the breakdown of 1.1652. In this case, the target is 1.1613. The potential value for the downward movement is the level of 1.1586 (the probable date of reaching (July 12 - 13)), from this level we expect a rollback to the top.

The short-term upward movement is possible in the corridor of 1.1694-1.1712 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 1.1738 and this level is the key support for the downward cycle.

The main trend is the downward structure of July 9.

Trading recommendations:

Buy: 1.1694 Take profit: 1.1710

Buy 1.1714 Take profit: 1.1735

Sell: 1.1650 Take profit: 1.1620

Sell: 1.1610 Take profit: 1.1590

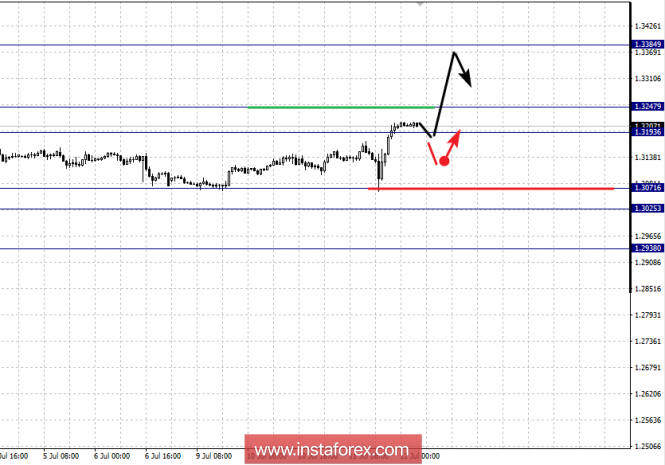

For the Pound / Dollar pair, the key levels on the H1 scale are 1.3329, 1.3297, 1.3274, 1.3192, 1.3155, 1.3131 and 1.3069. Here, the price forms the potential for the downward movement from July 9 and the development of this structure is expected after the breakdown of 1.3192. In this case, the target is 1.3155 and in the corridor of 1.3155 - 1.3131 is the consolidation of the price. The potential value for the top is the level of 1.3069 (the probable date of reaching 12 - 13 July), upon reaching this level, we expect a rollback upward.

The short-term upward movement is possible in the corridor of 1.3274 - 1.3297 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 1.3329 and this level is the key support for the downward structure from July 9.

The main trend is the formation of a downward structure from July 9.

Trading recommendations:

Buy: 1.3274 Take profit: 1.3295

Buy: 1.3298 Take profit: 1.3326

Sell: 1.3190 Take profit: 1.3160

Sell: 1.3153 Take profit: 1.3133

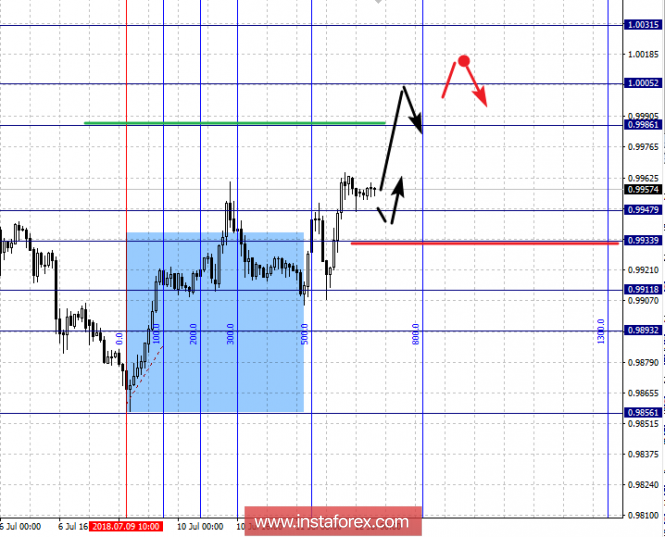

For the Dollar / Franc pair, the key levels on the scale of H1 are: 1.0031, 1.0005, 0.9986, 0.9947, 0.9933, 0.9911 and 0.9893. Here, we follow the development of the upward structure of July 9. At the moment, we expect the move to 0.9986, upon reaching which we expect short-term upward movement in the corridor of 0.9986 - 1.0005. The potential value for the top is the level of 1.0031 (the probable date of reaching 12 - 13 July), upon reaching this level we expect a pullback downwards.

The short-term downward movement is possible in the range of 0.9947 - 0.9933 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 0.9911 and this level is the key support for the top. Its breakdown will have a downward movement. In this case, the target is 0.9893.

The main trend is the upward structure of July 9.

Trading recommendations:

Buy: 0.9956 Take profit: 0.9984

Buy: 0.9988 Take profit: 1.0003

Sell: 0.9945 Take profit: 0.9935

Sell: 0.9930 Take profit: 0.9914

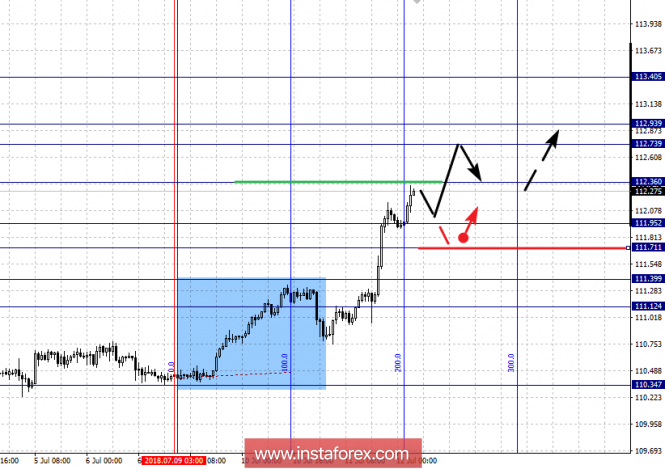

For the pair Dollar / Yen, the key levels on a scale of H1 are: 113.40 - 112.93, 112.73, 112.36, 111.95, 111.71, 111.39 and 111.12. Here, the price we follow the upward structure of July 9. The continued upward movement is expected after the breakdown of 112.36. In this case, the target is 112.73 and in the corridor of 112.73 - 112.93 is the consolidation. Hence, there is a high probability of a pullback downwards. The potential value for the top is the level of 113.40 (the probable date of reaching 13-14 July).

The short-term downward movement is possible in the corridor of 111.95 - 111.71 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 111.39 and the range of 111.39 - 111.12 is the key support for the top. Before it, we expect a local structure for the downward movement.

The main trend: the upward structure of July 9.

Trading recommendations:

Buy: 112.38 Take profit: 112.70

Buy: 112.95 Take profit: 113.40

Sell: 111.95 Take profit: 111.73

Sell: 111.68 Take profit: 111.40

For the Canadian Dollar / Dollar pair, the key levels on the H1 scale are: 1.3384, 1.3247, 1.3193, 1.3071, 1.3025 and 1.2938. Here, the situation is in an equilibrium state. The short-term upward movement is expected in the corridor of 1.3193 - 1.3247 and the breakdown of the last value should lead to the formation of initial conditions for the upward cycle. Here, the potential target is 1.3384.

The short-term downward movement is possible in the corridor of 1.3071 - 1.3025 and the breakdown of the latter value will lead to the formation of a potential for downward movement. Here, the target is 1.2938.

The main trend is the equilibrium situation.

Trading recommendations:

Buy: 1.3250 Take profit: 1.3380

Buy: Take profit:

Sell: 1.3025 Take profit: 1.2940

Sell: Take profit:

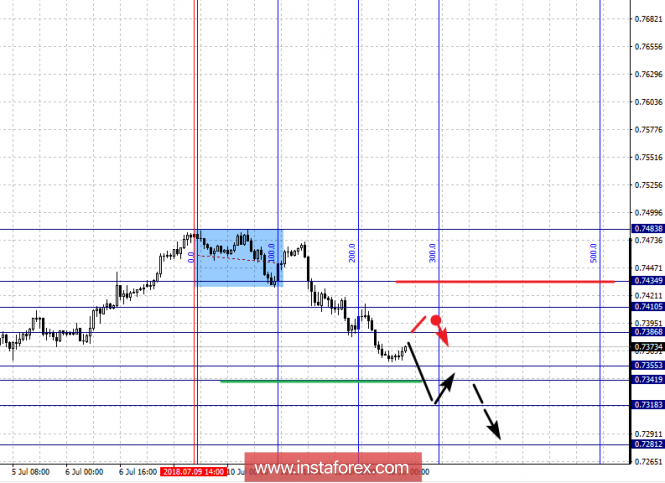

For the Australian Dollar / Dollar pair, the key levels on the scale of H1 are: 0.7434, 0.7410, 0.7386, 0.7355, 0.7341, 0.7318 and 0.7281. Here, we follow a small downward cycle from July 9th. The continued downward movement is expected after passing through the noise range of 0.7355 - 0.7341. In this case, the target is 0.7318. The potential value for the top is the level of 0.7281 (the probable date of reaching July 13)

The short-term upward movement is possible in the corridor of 0.7386 - 0.7410 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 0.7434 and the breakdown of this value will have to develop an ascending structure, here the potential target is 0.7483.

The main trend is the downward cycle from July 9.

Trading recommendations:

Buy: 0.7386 Take profit: 0.7408

Buy: 0.7411 Take profit: 0.7432

Sell: 0.7340 Take profit: 0.7320

Sell: 0.7316 Take profit: 0.7284

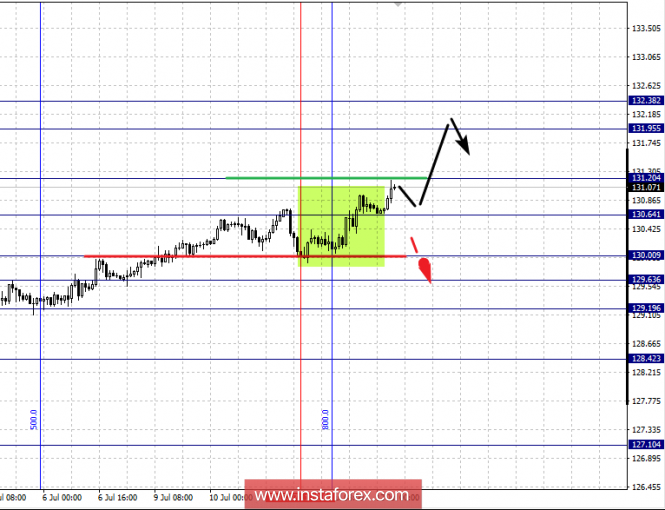

For the pair of Euro / Yen, the key levels on the scale of H1 are: 132.38, 131.95, 131.20, 130.64, 129.90, 128.80, 128.34, 127.74 and 127.06. Here, the price has issued a local structure for the top of 11 July. In the corridor of 130.64 - 131.20, we expect short-term upward movement, as well as consolidation. The potential value for the top is the level of 132.38, after which we expect consolidated movement in the corridor of 131.95 - 132.38.

The short-term downward movement is possible in the corridor of 130.00 - 129.63 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 129.19 and this level is the key support for the upward structure from June 28. Its breakdown will have to move up to the potential target of 128.42.

The main trend is the upward structure of June 28, the local structure for the top of July 11.

Trading recommendations:

Buy: 131.20 Take profit: 131.90

Buy: 132.00 Take profit: 132.35

Sell: 130.00 Take profit: 129.65

Sell: 129.60 Take profit: 129.20

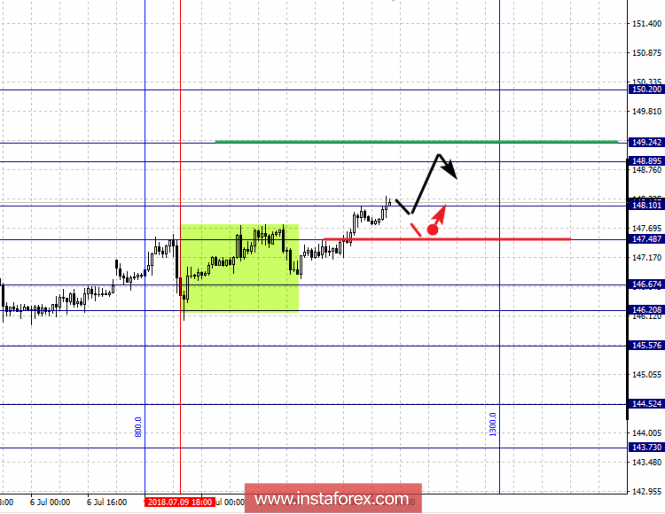

For the Pound / Yen pair, the key levels on the scale of H1 are: 150.20, 149.24, 148.89, 148.10, 147.48, 146.67, 146.20, 145.57 and 144.52. Here, we follow the formation of the local upward structure of July 9. The consolidated traffic is possible in the corridor of 147.48 - 148.10 and the breakdown of the last value should be accompanied by a pronounced upward movement. Here, the target is 148.89 and in the corridor of 148.89 - 149.24 is the consolidation. The potential value for the top is 150.20, but we expect the move to this level after the local structure is formalized.

The short-term downward movement is possible in the corridor of 146.67 - 146.20 and the breakdown of the last value will lead to an in-depth correction. Here, the target is 145.57 and this level is the key support for the upward structure of June 28. Its breakdown will have a downward movement. In this case, the target is 144.52 .

The main trend is a local structure for the top of July 9.

Trading recommendations:

Buy: 148.15 Take profit: 148.85

Buy: 149.26 Take profit: 150.20

Sell: 147.40 Take profit: 146.70

Sell: 146.65 Take profit: 146.20

The material has been provided by InstaForex Company - www.instaforex.com