Daily Outlook

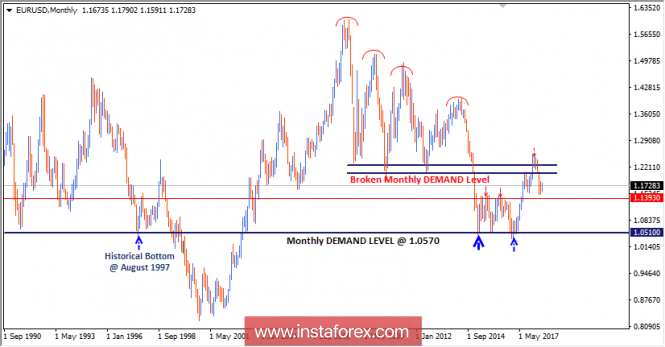

In April 2018, the short-term outlook turned to become bearish when the EUR/USD pair maintained trading below the broken uptrend as well as the lower limit of the depicted consolidation range.

Shortly after, the price zone (1.1850-1.1750) offered temporary bullish rejection towards 1.1990 where a descending high was established. However, the EUR/USD bulls failed to pursue towards higher bullish targets.

Instead, further bearish momentum below the price zone was expressed in the market.

In June 2018, the price zone (1.1850-1.1750) offered significant bearish rejection which led to the bearish decline towards 1.1500.

The price zone of 1.1520-1.1420 was considered a prominent bullish demand where a valid bullish BUY entry was offered during the previous weeks' consolidations.

Hence, the EUR/USD pair remains trapped inside a consolidation range between the depicted key-levels of 1.1520 and 1.1800 until a breakout occurs in either direction.

Early weak signs of bearish rejection around 1.1800 are already manifested on the chart. That's why, further bearish movement should be anticipated towards 1.1670 initially.

Please note that any bullish breakout above 1.1750 will probably enhance further bullish advancement initially towards 1.1850 where further targets can be determined.

The material has been provided by InstaForex Company - www.instaforex.com