Just nine months before Britain's final withdrawal from the European Union, the British again began to muddy the water. The government of Theresa May began a full-scale crisis, as some members of her cabinet spoke out against the agreement reached with Europe, which they regarded as excessively mild and contrary to the will of the people expressed during the referendum. Not only that the Minister for Brexit Affairs resigned, so also the Foreign Minister slammed the door loudly. On the eve of such a large-scale event as the finalization of the divorce between Britain and the European Union, there was not enough for the complete happiness of the political crisis alone. Naturally, this led to a panic sale of the pound, since it is better to fix it even with a loss, rather than being a direct participant in the theater of the absurd with an unpredictable result. Well, a sharp drop in the pound, through the dollar index, triggered a decline in the single European currency. Although here, the dollar index is not needed, since the political crisis in Britain is directly affected by the European Union.

It's ridiculous, but the dollar already had a reason for growth due to data on consumer lending. First reviewed the previous values from $ 9.3 billion to $ 10.3 billion. Also, instead of the expected 12.5 billion dollars for May, Americans collected as much as $ 24.6 billion in consumer loans. That is, considering the number of working days in May, and on the weekend, American banks are not fundamentally working, every day Americans recruited consumer loans for more than $ 1 billion, so that you can easily dismiss any talk about the risk of a drop in consumer activity in the US.

Nevertheless, today the dollar will have to cool down somewhat, as together with the revision of previous results on consumer lending, the forecasts on the number of open vacancies were revised. If yesterday it was expected that the number of open vacancies should grow, which mitigated the negative effect caused by the latest report of the US Department of Labor, now they are expected to reduce from 6,698 to 6,583 thousand. In other words, the increased army of free labor is no longer offered so many free jobs. Naturally, this threatens an even greater deterioration of the situation in the labor market.

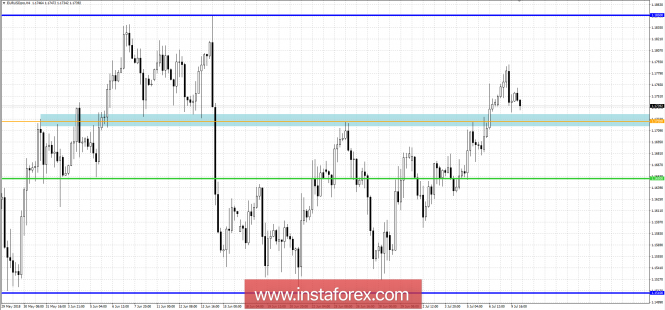

The euro / dollar currency pair, following the pound, jerked down, returning us to the region of the 1.1720 range. It is possible to assume that the quotation will try to restore positions, returning us to the values of 1.1760 / 1.1775.