GBP/USD has been slightly bullish recently after retesting the 1.32 as resistance. The price is expected to trade with the bearish bias in the coming days. The pair is likely to trade with higher volatility ahead of the widely-expected rate hike by the Bank of England to 0.75% from the previous value of 0.50% along with BOE Outlook reports this Thursday.

Today, there is no macroeconomic report to support GBP gains, but a series of economic reports will be published on Thursday. The rate hike decision is viewed as the necessity by the Bank of England to keep the economy running and avoid the risk of turning into recession. Though GBP has been weighed down by lingering trade jitters and uncertainty in the Brexit talks, the rate hike on Thursday is expected to provide the definite momentum and set the near-term course for the pound sterling.

On the other hand, ahead of the NFP report this week which is expected to be quite mixed, despite the recent positive Pending Home Sales report, USD failed to gain momentum which indicates the market sentiment on GBP/USD. Today, US Core PCE Price Index report is going to be published which is expected to decrease to 0.1% from the previous value of 0.2%, Employment Cost Index is expected to decrease to 0.7% from the previous value of 0.8%, Personal Spending is expected to increase to 0.4% from the previous value of 0.2%, Personal Income is expected to be unchanged at 0.4%, and Chicago PMI is expected to decrease to 61.9 from the previous figure of 64.1. Additionally, the most significant report of all, CB Consumer Confidence report is going to be published today as well which is expected to show a slight increase to 126.5 from the previous figure of 126.4.

At present, GBP has a lot to show this week amid the important policy decision like a rate hike which is not frequently taken by the British regulator. Since the recession of 2008-2009, this will be the 2nd Rate Hike for the UK so far which is expected to inject a good amount of volatility and trigger price swings this week. On the USD side, the forecasts are quite mixed and expected to put the market into indecision before the news is published. If the US manages to publish better than expected reports today, we might see further downward momentum in the coming days.

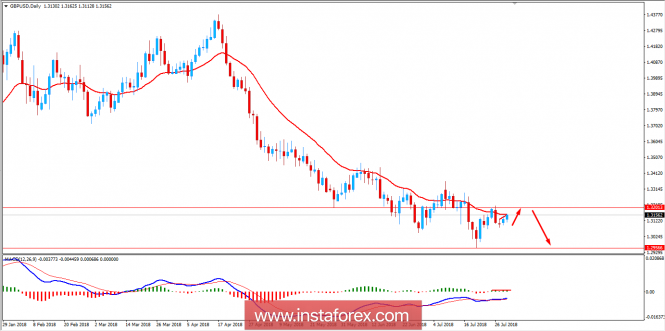

Now let us look at the technical view. The price is currently pushing higher to reach the 1.32 area for another retest before the price push lower as per long-term trend existing in the market since April 2018 rejecting off the 1.4375 area. Currently the price is expected to push lower with target towards 1.2950 area and as the price remains below 1.32 area with a daily close, the bearish bias is expected to continue further.

SUPPORT: 1.2950

RESISTANCE: 1.3200

BIAS: BEARISH

MOMENTUM: VOLATILE