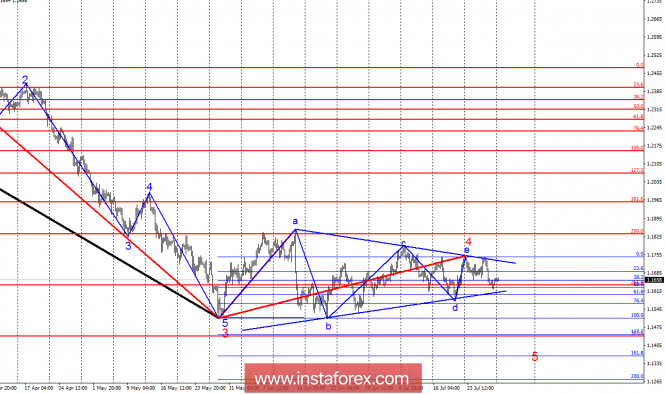

Analysis of wave counting:

During the Friday trading session of the EUR/USD pair gained about 40 bp from the low of the day and still remains within the narrowing corridor. As before, wave 4 is considered complete. If that is the case, the decline in quotations will continue within the first wave in the future of the 5th. Confirmation of the implementation of this option can be considered a successful attempt to break the lower forming a narrow corridor of the line. A breakthrough of the upper corridor line will entail changes in the current wave counting.

Goals for sales:

1.1507 - 100.0% - according to Fibonacci

1.1444 - 127.2% Fibonacci retracement

Goals for shopping:

1.1834 - 200.0% by Fibonacci

1.1957 - 161.8% Fibonacci retracement

General conclusions and trading recommendations:

The 4th wave correction is still characterized as fully completed. Thus, it is recommended for the pair to continue selling for a downward wave 5 with first targets located near the 1.1507 and 1.1444 levels, which corresponds to 100.0% and 127.2% of Fibonacci. To buy the pair, it is recommended to return only after breaking the upper line of the corridor and after specifying the entire wave counting. The material has been provided by InstaForex Company - www.instaforex.com