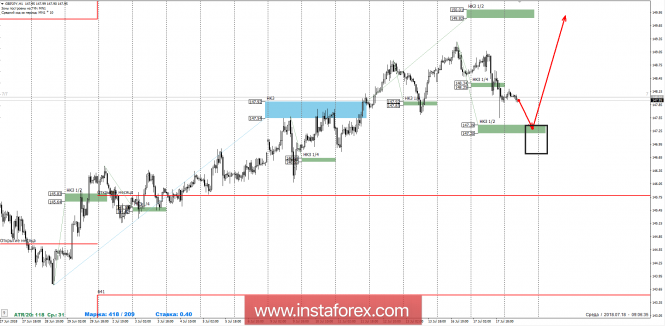

July's growth is a strong medium-term impulse, which allows you to look for purchases in any downward movement that does not exceed the corrective control zone. This week, a local accumulation zone is being formed.

Since the beginning of this week, a downward correction model has been formed, the purpose of which is to test the NCP 1/2 147.39-147.20, where it will be possible to obtain the most favorable prices for the purchase of the instrument. The ratio of risk to profit with a purchase from NCP 1/2 will exceed 1 to 3, which makes it profitable in the medium term, since the objective is the NCP 1/2 of 150.01-149.82.

Growth from current marks is less likely because yesterday's daily absorption pattern was formed, which increases the likelihood of today's decline and update of yesterday's low.

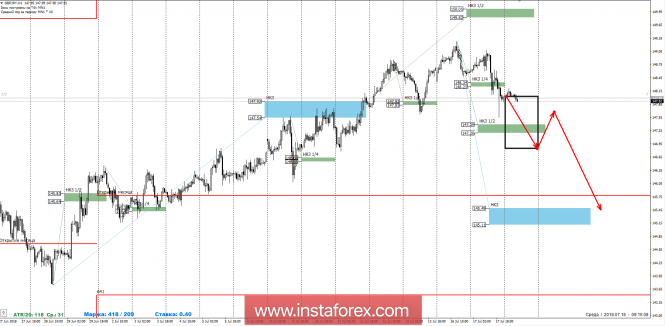

To form a reversal pattern, closing today's trades lower than the NCP 1/2 147.39-147.20 will be required. This will allow you to cancel purchases and close the balances of the previous long position. Sales will be possible tomorrow after the opening of trading below the level of 147.39. The probability of forming a reversal model is 30%, which makes sales from current marks less profitable. In case of confirmation of the downward movement, the target of the fall will be weekly short-term fault 145.49-145.11.

The daily short-term fault is the daytime control zone. The zone formed by important data from the futures market, which change several times a year.

The weekly short-term fault is the weekly control zone. The zone formed by important futures market marks, which change several times a year.

The monthly short-term fault is the monthly control zone. The zone, which is a reflection of the average volatility over the past year.

The material has been provided by InstaForex Company - www.instaforex.com