EUR / USD

On Wednesday, neither bulls nor bears showed themselves on the market. There were no strong reasons for the movement, and political developments in Iran, NAFTA, and re-elections in Italy still require further details and any development. The industrial production volume in France for April showed a decline of 0.4% against the forecast of + 0.4%. Italy's retail sales in March decreased by 0.2% against the expected growth of 0.1%. The US data also came in slightly weaker than expected. Producer Price Index (PPI) for April added 0.1% against expectations of 0.2%, while the base PPI coincided with the forecast level of 0.2%. The final evaluation for wholesale inventories in commercial warehouses for March were revised downward from 0.5% to 0.3%, with an expectation of an increase to 0.6%. Nevertheless, the Federal Reserve Bank of Atlanta counted the data as part of 4% GDP growth for the second quarter. The US stock index Dow Jones added 0.75%, as US oil companies are clearly pleased with the growth of oil (Exxon Mobil 2.36%, Chevron 1.70%). Even in OPEC, they started talking about losing the point to maintain the current production quotas. The growth of oil brought pressure to the dollar, but, on the other hand, this pressure negates the growth of US government bond yields. Yesterday, the yield of 10-year securities increased from 2.976% to 2.995% (in the moment reached 3.014%).

Today is holiday in Germany, France, and Switzerland. The main event of the day will be the decision of the Bank of England on monetary policy. Investors do not expect a change in the rate, but if the balance of votes shifts towards and increase by 3-6 against 2-7 for instance, as it shown at the last meeting, then the correction for the pound may take place along with the euro's growth.

On the United States, there are important indicators on inflation. The base CPI for April is expected to grow by 0.2%, which on an annualized basis can show an increase from 2.1% to 2.2% YoY. The total CPI is expected to grow by 0.3%, which on an annualized basis could increase from 2.4% to 2.5% YoY. The number of initial applications for unemployment benefits is projected at 219 thousand against 211 thousand last week. At 7:00 PM London time, the budget report for April will be published, with a forecast at $ 201.2 billion compared to -208.7 billion in March. Although in April, the traditional surplus linked with the payment of taxes to the budget will shown an expected figure to be in the record of US history. The last record was in April last year at 182 billion dollars (on that day the euro fell by only 10 points).

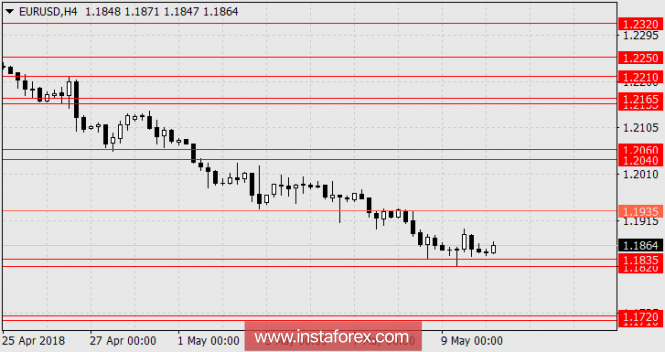

Thus, the behavior of the euro is not defined in the current situation even after a nearly monthly decline (since April 17), by which only 3 days were correctional. Regardless of whether the correction happens or not, we are expecting the euro in the range of 1.1710 / 20.

* The presented market analysis is informative and does not constitute a guide to the transaction.

The material has been provided by InstaForex Company - www.instaforex.com