On Wednesday, the investors' attention was attracted to the threatening speech of Donald Trump against Iran. "Shaking" the air with the new threats of punishments, American president did not forget about melodrama, abundantly adding the promises of "serious consequences if the Iranian Republic does not stop working in the field of acquiring nuclear weapons" to his threats.

His comments did not have any negative impact on the US stock market, which does not seem to believe in the reality of Trump's determination. But, the prices for crude oil resumed positively dynamic, supported by the increased geopolitical risks of the emergence of a new hot spot in the Middle East.

The foreign exchange market continues to live its own life. A fairly overbought dollar was under slight pressure against the background of the publication of data on industrial inflation in the United States. The data turned out to be weaker than the forecasts, which, most likely, was the reason for the partial fixation of the previously received profit.

According to the published data, the producer price index (PPI) on an annual basis grew less than expected. The indicator grew by 2.6% while it grew by 3.0% in the previous period. with an expected increase of 0.2% compared to a 0.3% rise in March. The base value of the producer price index (PPI) fell year-on-year, adding 2.3%, while an increase of 2.4% was expected in line with the March growth of 2.7%.

But again, in our opinion, the published data is just a pretext for fixing profits, and nothing else. Previously, the market has always ignored data on production inflation, focusing on the figures for consumer inflation. Therefore, we believe that the decline in the dollar may be local and it is already on the new wave, perhaps positive figures will cause growth to continue. It was predicted that it would add 2.8% in April but only added 0.1% on a monthly basis.

Forecast of the day:

The GBP/USD pair is consolidating in the range of 1.3500 - 1.3600. It can resume the decline when it becomes clear that raising rates should not be expected in the near future. In this situation, the pair may fall to 1.3450.

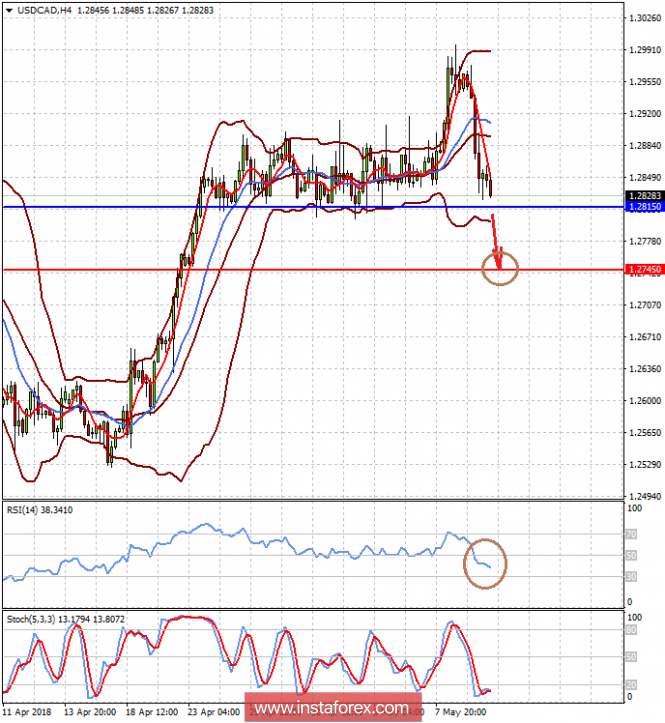

The USD/CAD pair is falling on the wave of the U.S. withdrawal from the nuclear deal with Iran, which has worsened not only the geopolitical situation but will become the basis for sanctions on the country's oil exports to the world market. The growth of crude oil quotations supports the rate of the Canadian currency. A breakout at the level of 1.2815 could lead to a decline towards 1.2745.