USD/JPY has been quite volatile, making correction in the overall impulsive non-volatile bullish trend for more than month now. Due to recent downbeat economic reports from the USD, certain confusion has arisen in the market which led to certain volatility and consolidation, being observed currently.

Ahead of the Retail Sales and Building Permits reports to be published this week, USD seemed to be sustaining the bullish impulsive pressure in the market that is expected to push the price higher in the coming days. Today, FOMC Member Mester is going to speak about upcoming interest rate decisions and monetary policies. Her speech is expected to have little impact on the gains of USD this week. Moreover, the Retail Sales report to be published tomorrow is expected to decrease to 0.4% from the previous value of 0.6% and Building Permits is expected to be unchanged at 1.35M. As no definite hawkish forecast is made on the USD side this week, certain volatility may remain on the pair throughout the week.

On the JPY side, today PPI report was published with a slight decrease to 2.0% from the previous value of 2.1% as expected and Prelim Machine Tool Orders report was also published with a decrease to 22.0% from the previous value of 28.1%.

As for the current scenario, JPY has been quite dovish with the economic reports today as well, which put the market into greater confusion already. This is likely to lead to certain consolidation and volatility along the way. Until USD comes up with better economic reports to push the price higher with enormous pressure in the coming days, further correction is expected in this pair.

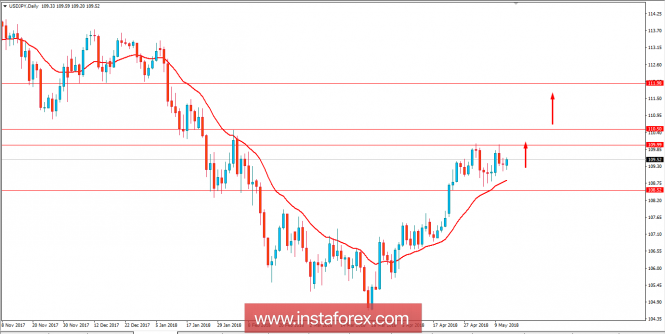

Now let us look at the technical view. The price is currently quite bullish, proceeding higher towards 100.00-50 resistance area with a dynamic level of 20 EMA acting as support along the way. The price is expected to push higher under the current market conditions but certain consolidation and correction is expected throughout the process. If the price breaks above 110.50 with a daily close, further bullish momentum with a target towards 112.00 is expected in the future. As the price remains above 108.50 area, the bullish bias is expected to continue further.