Rumors about the normalization of the BOJ's monetary policy, the threat of a global trade war and the growth of political risks in the euro area against the backdrop of the Eurosceptic during the parliamentary elections in Italy allowed the "bears" to bring USD/JPY quotes closer to 16-month lows. Safe haven assets are bought as hot pies, and the forecast of £80 per dollar in 2019 no longer looks like science fiction.

The strengthening of the yen was facilitated by Haruhiko Kuroda's statement about withdrawing from the ultra-soft monetary policy in case of inflation targeting 2% in the 2019/2020 fiscal year. If this happens, then "there is no doubt" that the members of the Governing Council will discuss the issues of normalization. At first glance, everything is logical: the economy of the Land of the Rising Sun has the second longest economic expansion since the beginning of the century, unemployment drops to 2.4%, the lowest level since 1993, and the number of open vacancies (159 jobs for 100 people looking for work) has skyrocketed up to a 44-year peak. Nevertheless, given the aging of the population, life-long contracts and the reluctance of corporations to spend money on raising wages, it is difficult to expect the growth of the last indicator by 3%.

Societe Generale wonders how such a rhetoric can be combated with the appreciation of the yen. In fact, the markets misinterpreted it. Even at the end of last year, Haruhiko Kuroda mentioned a normalization of monetary policy, given that the BoJ has confidence in the growth of inflation towards the target. Now the rhetoric has turned out to be more "dovish", but investors are very sensitive to any words about the course change, sincerely hoping that the yen will repeat the last year's path of the euro.

Why not? Moreover, the currency of the Land of the Rising Sun has a favorable external background in its arsenal. The exchange of barbs between the US and the EU over import duties increased the risks of a global trade war and also made us remember the events of the 1990s. Afterwards, the USD/JPY pair fell to the mark of 80 against the backdrop of worsening relations between Washington and Tokyo.

Dynamics of USD/JPY

Source: Bloomberg.

Theoretically, trade wars will lead to a slowdown in global GDP, which is a "bearish" factor for the monetary units of developing countries. The exit from the carry trade and the return of investors to the funding currencies allows the USD/JPY pair to continue the downward campaign.

Another driver of strengthening the yen is the political situation in Italy. Preliminary counting of votes signals the victory of Eurosceptics ("Five Star" - 32%, Northern League - 18%). If they manage to create a coalition, then along with the issues of restructuring the national debt, the idea of the country's exit from the eurozone may be revived. Uncertainty forces foreign investors to think three times before taking money to the markets of the eurozone.

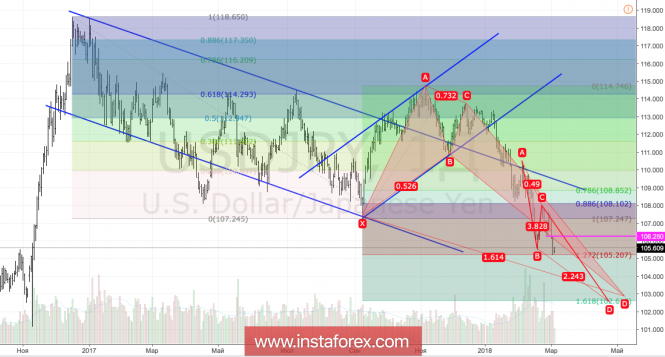

Technically, a breakthrough of support at 105.2 will allow the "bears" to expect the continuation of the USD/JPY peak in the direction of the targets by 161.8% and 224% on the "Crab" and AB = CD patterns. They form a convergence zone just below the 103 yen mark for the dollar. The nearest resistance levels should be sought near 106.25 and 107.25.

USD/JPY, daily chart