In the absence of fresh drivers of growth, oil switched to signals from other markets. Thus, the weakness of the US dollar and the growth of stock indices allowed the quotations of Brent to storm an important level of $ 65 per barrel. The factors of supply disruptions from Libya and the growth of political uncertainty in Venezuela, where the Presidential elections scheduled for April 22 were postponed for a month, are extremely shaky "bullish" drivers for black gold. At the same time, the report of the International Energy Agency does not allow buyers to properly develop.

According to the IEA, the USA will become the world's No. 1 producer by 2023, increasing production from 10.6 million b / s in 2017 to 12.1 million b / s. About 60% of the cumulative increase in the supply of black gold to the world market in the period from 2017 to 2023 will be linked to the United States. Americans will cover up to 80% of the increase in global demand until 2020, and OPEC will have to expand its cooperation with Russia and other countries in order to achieve a balanced market against such a background.

The dynamics of WTI and American oil production

Source: Bloomberg.

However, there is good news for the bulls too. The International Energy Agency expects that despite the slowdown in global demand growth, it will increase by an average of 1.1 million b / s to 2023. And reaching a maximum is not yet foreseen. According to BMI Research, the acceleration of the rebalancing process in the oil market, strong global demand and lags behind it make it possible to expect that the average price for Brent this year will be $ 67 per barrel.

Thus, the process of tug-of-war between OPEC and the States in the oil market continues, the strategies of the opponents are clear, so the further dynamics of Brent and WTI, in my opinion, will depend on the global demand and the positions of the US dollar. The fact that in the first quarter of the world economy begins to slow down, as evidenced by the indices of business activity in the leading countries of the world, does not add optimism to the "bulls" for black gold. On the other hand, there is no need to panic about this. For the States, for example, January-March in the past few years is an extremely unfavorable period that many Bloomberg experts associate with bad weather. In addition, the constant rapid growth of the world economy increases the risks of its overheating and recession. I think in the second quarter, the situation will change for the better.

As for the US dollar, its medium-term prospects are drawn in gray paints, while retreat into the shadow of the risks of the global trade war and the return of investors' interest to the divergence theme in the monetary policy of the Fed and other central banks allows us to expect a short-term growth in the USD index.

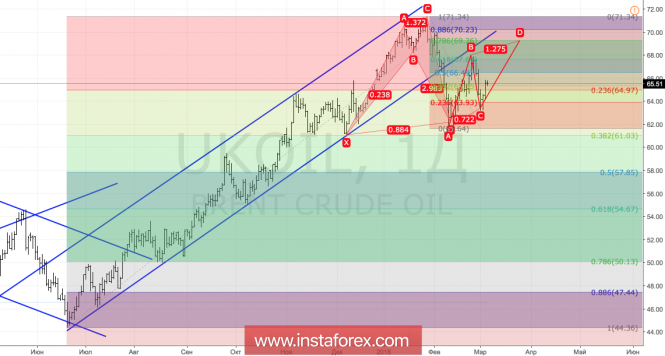

Technically, Brent continues the transformation of the pattern "Shark" at 5-0. The further fate of the North Sea variety will depend on the ability of the "bulls" to storm the resistance by $ 66.45. If it turns out, we will see oil at $ 69.35, no correction, most likely, will continue.

Brent, daily chart