USD/CAD is currently residing at the edge of the 1.29 price area with extreme volatility in place after the impulsive non-volatile bullish trend. Ahead of the CAD high impact economic reports today, certain volatility is taken as quite normal. Today, USD Core PCE Price Index report is going to be published which is expected to decrease to 0.2% from the previous value of 0.3%, Personal Spending is expected to be unchanged at 0.2%, Unemployment Claims is expected to increase to 230k from the previous figure of 229k, and Personal Income is also expected to be unchanged at 0.4%. Moreover, Chicago PMI report is expected to have a slight increase to 62.1 from the previous figure of 61.9, Revised UoM Consumer Sentiment is expected to have a slight decrease to 101.9 from the previous figure of 102.0, and Revised UoM Inflation is expected to be neutral which previously was at 2.9%. On the other hand, today, CAD GDP report is going to be published which is expected to be unchanged at 0.1%, RMPI report is expected to decrease to 2.8% from the previous value of 3.3%, and PPI report is expected to increase to 0.4% from the previous value of 0.3%. As of the current scenario, CAD economic reports are forecasted quite indecisive as providing no such evidence of further gains whereas USD positive GDP report which recently published already had an impact on the market. To sum up, USD is expected to gain more momentum in the coming days over CAD.

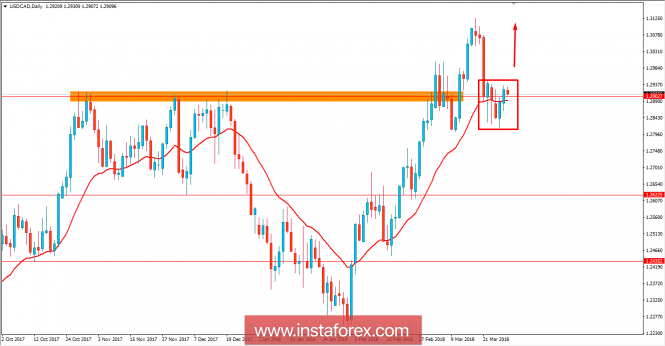

Now let us look at the technical view. The price is currently residing above the 1.29 price area with a daily close with the confluence of dynamic level of 20 EMA holding as a support as well. As of the recent bullish strong trend in the market, the price is expected to push higher towards 1.30 in the coming days. As the price remains above 1.29 with a daily close, further bullish pressure is expected.