EUR/USD has been quite bearish today after rejecting off the 1.2350 price area after the recent impulsive bullish pressure off the 1.2150 area. Ahead of the Rate Hike by the US Fed this month, EUR/USD has been quite indecisive whereas EUR is recognized to be the leading currency for the moment. Today, Spanish Services PMI report is going to be published which is expected to have a slight decrease to 56.5 from the previous figure of 56.9, Italian Services PMI is expected to decrease to 57.3 from the previous figure of 57.7, French Final Services PMI is expected to be unchanged at 57.9, and German Final Services PMI is also expected to be unchanged at 55.3. Moreover, eurozone's Final Services PMI is expected to be unchanged at 56.7, Sentix Investor Confidence is expected to decrease to 31.1 from the previous figure of 31.9, and Retail Sales are expected to increase to 0.3% from the previous negative value of -1.1%. On the other hand, today US Final Services PMI report is expected to be unchanged at 55.9, ISM Non-Manufacturing PMI is expected to decrease to 58.9 from the previous figure of 59.9, and FOMC Member Quarles is going to speak today about the US funds rate which is likely to increase this month. As for the current scenario, ahead of the upcoming Non-Farm Employment Change, Average Hourly Earnings and Interest Rate hike, USD is expected to gain further momentum against EUR whereas EUR is expected to struggle for gains amid soft economic reports in the coming days.

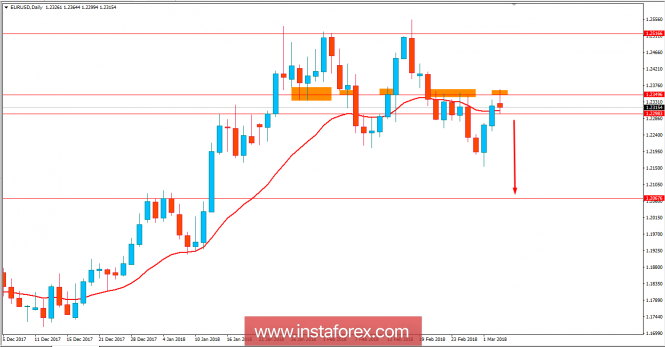

Now let us look at the technical view. The price is set to breach below 1.23 price area with a daily close which may lead to further bearish pressure towards 1.2000-50 support area in the coming days. The bears are still quite strong in the market. So, the bearish pressure may continue further until the price remains below 1.2350 with a daily close.