The previous week ended with another wave of selling in stock markets, and although the collapse has not yet taken the form of a panic flight, all the prerequisites for that ensures that the new week will open "on a black Monday" than on February 5.

A month ago, the market showed a very nervous reaction to the prospects of accelerating the pace of rate hikes of the Fed, thus expressing its position on the pace of recovery in the US economy. The market does not believe that these rates are sufficient enough to seriously talk about the acceleration of policy tightening.

A new wave of selling was initiated by US President Donald Trump, who announced plans to impose tariffs on the import of steel at a rate of 25% and aluminum at a rate of 10%. Trump promised to present the details this week, which means that it is unlikely to expect a positive opening of the week.

As soon as Trump announced his intention, the head of the Federal Reserve Bank of New York Robert Dudley made a comment. Speaking in Brazil, Dudley said that the increase in tariffs would lead to higher prices for goods made from these metals, which will raise price pressure, meaning the Fed would have to increase the rate of tightening of monetary policy.

The dry residue of these words mean that the likelihood of four rate hikes this year has increased. The market understood that, starting out from risky assets, the dynamics of the fall of stock indices in many ways is similar to the one that was seen in the beginning of February.

The main US trading partners reacted immediately. The deputy chairman of the Chinese Association of Metallurgical and Steel Industry called the US decision to introduce a fee "stupid," the Japanese economy minister said on Friday that imports of steel and aluminum do not affect the national security of the United States, Canada called the tariffs unacceptable, Australia's trade minister was disappointed, while the head of the European Commission Juncker promised full-scale counter measures.

Fed Chairman Jerome Powell also expressed his opinion on the rates in his second speech in Congress, saying that the US economy does not face overheating, and therefore it is necessary to adhere to the gradual pace of tightening monetary policy.

Nevertheless, the move has been made, and the foreign exchange markets are obliged to react. The hardest hit is the Canadian dollar, which could drop to 1.3050 in the short term and to 1.38 in the long term. The reason is that Canada is the largest steel supplier in the US, and Trump's statement points to an attempt to revise, first of all, the NAFTA agreement.

The threat of a full-scale trade war has once again become more than real, and against this background, the special demand for the Japanese yen as the most obvious defensive asset, the usdjpy rate may fall to 103.50, since the yen also has an internal driver - which the head of the Bank of Japan promised in 2019. A consideration of the completion of the incentive program is certainly a bullish promise for the Japanese currency.

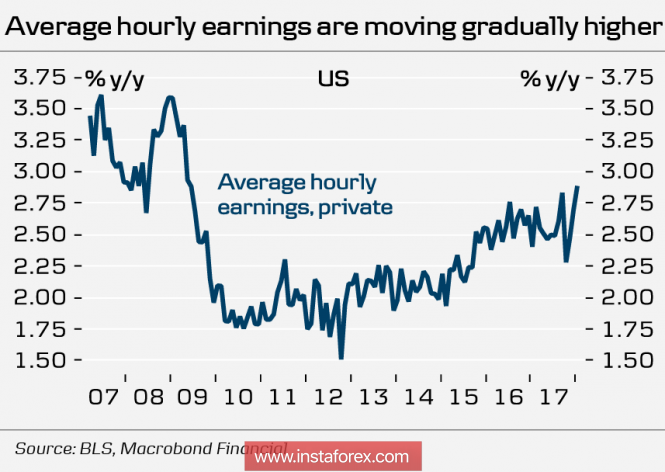

This week, the US will report on employment for February. The number of new jobs is projected to be slightly lower than 200 thousand in January, which in itself is a very good indicator, but the focus will be on the growth rate of average wages - a key factor in the acceleration of inflation. The last two months showed that growth was quite strong, however, the US economy can not maintain such a pace for a long time, and therefore the data for February can be disappointing.

The dollar finished the previous week under pressure, and until the situation around the tariffs is approved, selling in the markets will continue, and the dollar will not be able to resume growth.

Attention will also be directed to the comments of FOMC members, among whom Robert Dudley stands out, who, after the resignation of Stanley Fisher, becomes the most influential member of the current Cabinet. It is to Dudley's words that the market will be guided to the greatest extent in order to assess the risks of four rate hikes this year.

In general, the situation for the dollar is still unfavorable. On Monday, the demand for defensive assets will increase, the risk of a selloff will continue, we should also pay attention to the publication of the ISM PMI index for February, and the main events should unfold on Tuesday and Wednesday, when both Trump and Dudley will offer new benchmarks to the market.

The material has been provided by InstaForex Company - www.instaforex.com