EUR/JPY has been extremely volatile recently having an impulsive bullish candle of 200 pips yesterday within a strong bearish trend which is expected to continue further. Today, the eurozone released a series of downbeat economic reports which helped JPY to gain momentum. Today, German Import Prices report was published with a decrease to -0.6% from the previous value of 0.5% which was expected to be at -0.3%, Spanish Flash CPI failed to meet the expectation of an increase to 1.5% from the previous value of 1.1% whereas resulted at 1.2%, M3 Money Supply decrease to 4.2% from the previous value of 4.5% which was expected to increase to 4.6% and Private Loans was published unchanged at 2.9% which was expected to increase to 3.0%. On the other hand, today Japan's SPPI report was published with a slight decrease to 0.6% which was expected to be unchanged at 0.7% and BOJ Core CPI report was published unchanged at 0.8% which was expected to decrease to 0.7%. The economic reports from Japan did not provide a significant positive push to the currency but they were better than the data from the eurozone that resulted in impulsive bearish pressure in the market. So trading sentiment shifted towards selling. As for the current scenario, JPY is expected to gain more momentum in the coming days against EUR whereas EUR may struggle to sustain its lead.

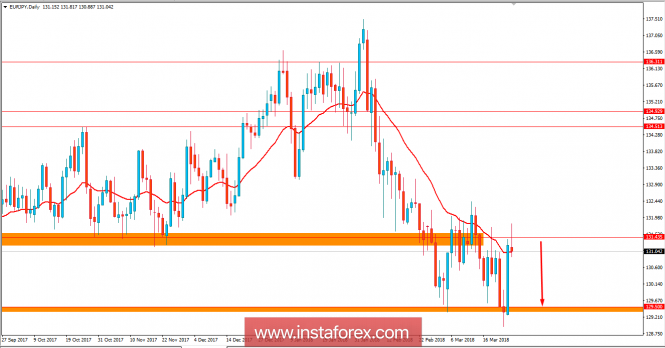

Now let us look at the technical view. The price has rejected the bulls off the 131.50 price area today amid impulsive bullish pressure of 200 pips yesterday. The pair is still quite volatile but the bearish trend seems strong enough to stop the bulls from creating further higher highs in the process. As the price remains below 131.50 with a daily close, further bearish pressure is expected to continue.