The US dollar is losing ground, not convincing anyone with strong economic data. EUR/USD remains strong above 1.22. The stock market is dominated by the greenback. Gold broke over 1,340 USD / oz. In addition, it is expected to be a quiet start to the week as the US celebrates Martin Luther King's Day.

On Monday 15th of January, the event calendar is light with important news releases. The only news worth to mention is the Trade Balance data from the Eurozone, the NZIER Business Confidence from New Zealand and the speech of MPC Member Silvana Tenreyro.

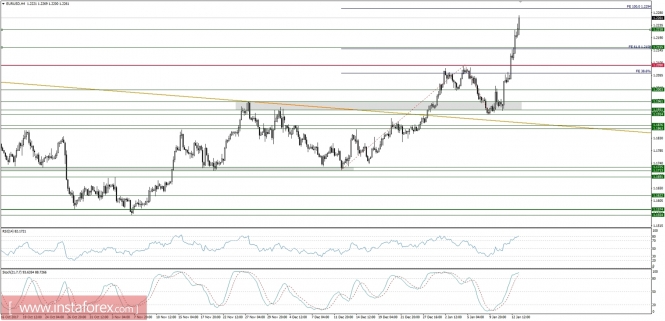

Analysis of EUR/USD for 15/01/2018:

The good and solid data from the US economy did not help the greenback to bounce and it is loosing ground across the board. The biggest winners in this situation are the major forex pairs such as EUR/USD, GBP/USD, and USD/CAD. Any news that is scheduled for release today do not have enough market impact to change this scenario.

Let's now take a look at the EUR/USD technical picture on the H4 time frame. The price has broken higher above the technical resistance at the level of 1.2090, broke through a 61% Fibo Extension and now is heading towards a 100% Fibo Extension at the level of 1.2294. The momentum is still strong during this move up, but the market conditions will soon begin to be overbought at this time frame. The nearest technical support is seen at the level of 1.2218.

Market Snapshot: Crude Oil still on highs

Crude oil prices have bounced again from the technical support at the level of 63.10 and are heading higher towards the recent highs at the level of 64.78 in overbought trading conditions. This might be a start of the bearish divergence as the momentum indicator is not growing up with the price. The nearest technical support for the price is seen at the level of 63.10 and 62.67.

Market Snapshot: US Dollar Index is sinking

The US dollar index has broken below the technical support at the level of 91.76, fell out of the black channel zone and now is moving straight down towards the next technical support at the level of 89.62 (weekly technical support). Please notice the market conditions are oversold on this time frame.