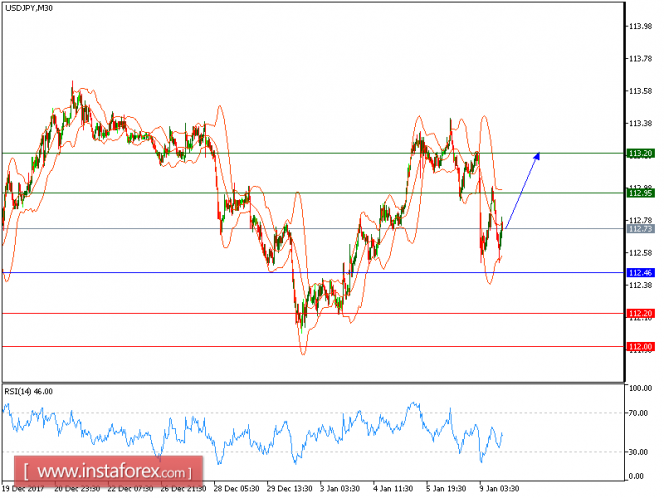

USD/JPY is expected to trade with bullish bias above 112.45. The pair continues its rebound from a low of 112.45 seen yesterday. Currently, it is trading at levels above both the 20-period and 50-period moving averages, while striking against the upper Bollinger band. The relative strength index is well directed above the neutrality level of 50, indicating continued upward momentum for the pair. Therefore, the intraday outlook remains bullish, and the pair should revisit 112.95 on the upside before proceeding to 113.20.

Alternatively, if the price moves in the opposite direction, a short position is recommended below 112.45 with a target of 112.20.

Chart Explanation: The black line shows the pivot point. The current price above the pivot point indicates a bullish position, while the price below the pivot point is a signal for a short position. The red lines show the support levels and the green line indicates the resistance level. These levels can be used to enter and exit trades.

Strategy: buy, stop loss at 112.45, take profit at 112.95.

Resistance levels: 112.95, 113.20, and 113.50

Support levels: 112.20, 112.00, and 111.75.

The material has been provided by InstaForex Company - www.instaforex.com