The British pound demonstrated its best start since 2014, strengthening against the US dollar caused by the growing hopes for a soft Brexit, the expectations of the continuation of the cycle of normalization of the monetary policy of the Bank of England, and the unwillingness of the "Greenback" to regain position on positive news. On the contrary, the negative news from the States is actively used by the bulls of the GBP / USD pair to build up long positions. Their size has reached a maximum mark last seen in March 2014.

According to the latest Reuters poll, the probability of Britain's withdrawal from the EU without a deal dropped from 25% in December to 20%. In October, the indicator reached 30%. European Commission President Jean-Claude Juncker said he would welcome the decision of the United Kingdom to return after the "divorce." Additional support for the sterling was provided by information about the readiness of the Social Democrats to negotiate with the Angela Merkel's bloc on the creation of a coalition. The latter is seen as a favorable option for London in negotiating for Brexit. However, Banco Santander drew attention to the fact that premiums on call options exceeded the value of put options placed on pound for the first time since 2009, which increases the risks of correction in case of negative headlines on Brexit.

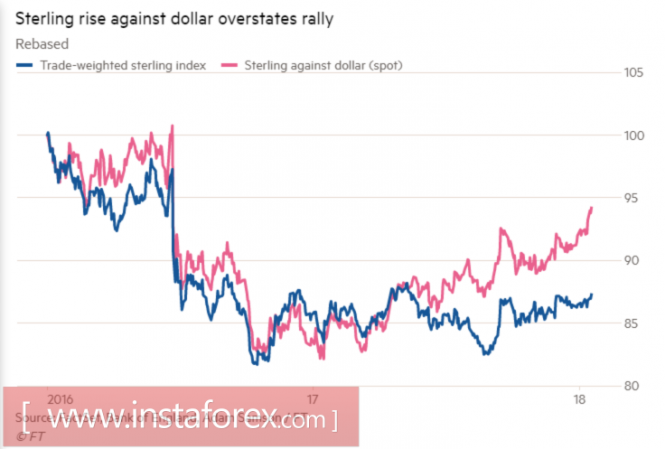

The weakness of the US dollar played a significant role in the near 3% rally of the GBP / USD since the beginning of the year. This is clearly seen from the comparison of the dynamics of the pair and the trade-weighted sterling rate. In its structure, 48% belongs to the euro and only 19.4% to the "Greenback". In this regard, information about the disconnection of the US government was enthusiastically received by the pound fans. In our opinion, the stability of the GBP TWI allows the Bank of England to adhere to the "hawkish" rhetoric, which is a bullish factor for the currency of the United Kingdom. It is quite capable of continuing the upward trend thanks to the previous drivers: a soft Brexit and expectations of BoE rebate on rate increase.

Dynamics of GBP / USD and the weighted trade rate of the pound

Source: Financial Times.

The "bulls" are not particularly upset for the analyzed pair and the data released on inflation and retail sales. The CPI slowdown, and in our opinion, should be considered as a positive signal for the pound. The matter is that in case of acceleration of average wages, real incomes of the population will increase. However, so will purchasing power, which will contribute to GDP growth. "Bears", on the contrary, pay attention to the reduction of labor in August-October. If the trend continues, this will be the first bell to worsen the conjuncture of the labor market of the United Kingdom. The release of employment data, coupled with the publication of statistics on GDP for the fourth quarter, allows the sterling to claim the title of the most interesting currency of the week.

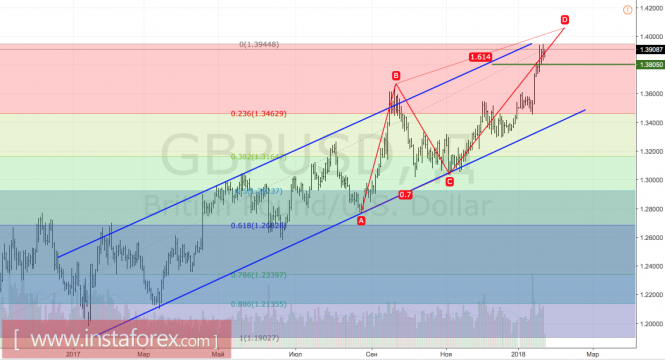

Technically, the GBP / USD pair has a stable upward trend. "Bulls" are seriously set to implement the target by 161.8% on the AB = CD pattern. It corresponds to 1.405. Meanwhile, quotes are above the support level at 1.3805. The ball is ruled by buyers of the pound.

GBP / USD, daily chart