Daily Outlook

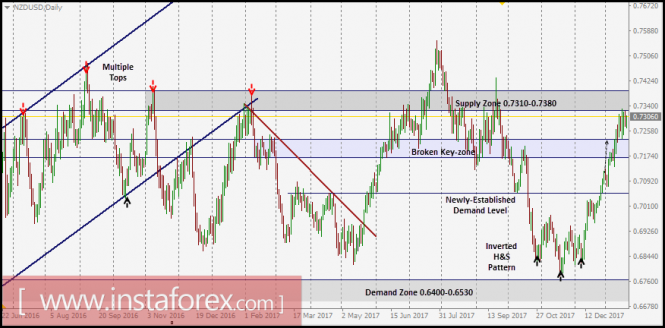

In July 2017, an atypical Head and Shoulders pattern was expressed on the depicted chart which indicated upcoming bearish reversal.

As expected, the price level of 0.7050 failed to offer enough bullish support for the NZD/USD pair. That's why, further bearish decline was expected towards 0.6800 (Reversal pattern bearish target).

Evident signs of bullish recovery was expressed around the recent low (0.6780). An inverted Head and Shoulders pattern was expressed around these price levels.

The price zone of 0.7140-0.7250 (prominent Supply-Zone) failed to pause the ongoing bullish momentum. Instead, a bullish breakout above 0.7250 was expressed on January 11.

That's why, the current bullish movement extended towards the price levels of 0.7240 and 0.7320.

A quick bullish movement is expected towards the depicted supply zone (0.7320-0.7390) where price action should be watched for evident bearish rejection and a valid SELL entry.

Trade Recommendations:

Conservative traders should be looking for a valid SELL entry anywhere around the depicted supply zone (0.7320-0.7390).

S/L should be located above 0.7450. T/P levels should be located around 0.7230, 0.7150 and 0.7090.

The material has been provided by InstaForex Company - www.instaforex.com