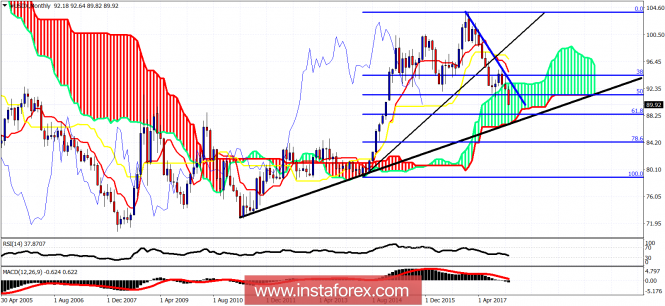

The Dollar index as expected made a new low. Trend remains bearish. The bullish divergence signs in the 4 hour chart are signaling that bears need to be very cautious and lower their stops to 91. As long as we are below 91 trend is bearish.

The Dollar index could reach the downward sloping green trend line at 89.50 this week. Trend is bearish as price is below both the tenkan- and kijun-sen indicators at 90.16 and 90.40 respectively. Cloud resistance is at 91.60-90.60 so as long as we are below it, bears are in control.