CHF has been quite impulsive with the gains over USD recently. So the pair has been trading in a non-volatile manner since it broke below 0.97 support area. Due to recent weakness of USD amid downbeat economic reports, CHF gained momentum which is expected to extend further in the coming days. Today, Switzerland's PPI report was published with a decrease to 0.2% from the previous value of 0.6% which was expected to be at 0.4%. Despite the worse-than-expected economic report from Switzerland today, the CHF gains are still quite strong against USD that indicates severe weakness of USD at the current moment. On the USD side, yesterday a Building Permits report was published with an unchanged reading along with disappointing economic reports on Housing Starts and Philly Fed Manufacturing Index. Today, US Prelim UoM Consumer Sentiment report is going to be published which is expected to increase to 97.0 from the previous figure of 95.9, Prelim UoM Inflation Expectation is expected to be neutral where previous it was at 2.7%, and FOMC Member Quarles is going to speak today on the Fed's key interest rate and future monetary policy. His speech is also expected to neutral and have a minor impact on further USD growth. As for the current scenario, CHF is expected to continue its gain further in the coming days against USD until the US comes up with better economic reports.

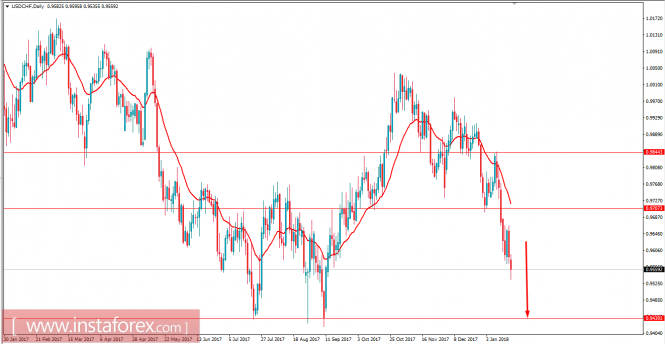

Now let us look at the technical view. The price is currently on its way towards 0.9450 support area with an impulsive price action and pressure. The price has been non-volatile and impulsive with the bearish gains. Without further correction the pair is expected to touch the support of 0.9450 in the short term. As the price remains below 0.97 with a daily close, the bearish bias is expected to continue further.