USD/CAD has been quite impulsive with declines today after certain indecision and correction below 1.24 price area. Despite recent upbeat economic reports, USD failed to sustain the gain over CAD which indicates severe weakness of USD in the coming days. Moreover, President Trump spoke recently about a tax rate reduction, so his speech is expected to have a good impact on the growth of the currency in the future. The US high impact economic reports like NFP, Average Hourly Earnings and Unemployment Rate report are to be published on Friday. Today, US ADP Non-Farm Employment Change report is due which is expected decrease to 186k from the previous figure of 250k, Employment Cost Index is expected to decrease to 0.6% from the previous value of 0.7%, Chicago PMI report is expected to decrease to 64.2 from the previous figure of 67.6, Pending Home Sales report is expected to increase to 0.5% from the previous value of 0.2%, and Crude Oil Inventories are expected to increase to 0.1M from the previous figure of -1.1M. Moreover, FOMC Statement and Federal Funds Rate report is going to be released today which is expected to be unchanged at 1.50%. On the other hand, today Canada's GDP report is expected to show an increase to 0.4% from the previous value of 0.0%, RMPI is expected to decrease to -2.2% from the previous value of 5.5%, and IPPI report is expected to decrease to -0.2% from the previous value of 1.4%. As for the current scenario, the economic reports from the US and Canada are expected to reveal mixed results. Amid high impact economic reports which are due today, a good amount of volatility is setting the tone on the market this week. Though CAD is leading with the better gains and momentum, certain spikes may lead to a short-term counter trend move in this pair along the way towards 1.21 support area.

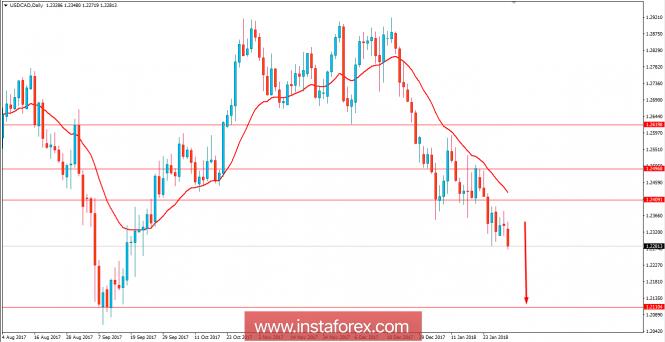

Now let us look at the technical chart. The price is holding below the 1.24 resistance area and dynamic level of 20 EMA which indicates the strength of the bears in the pair. Besides, the price is currently proceeding lower with an impulsive bearish pressure which is expected to reach 1.21 support area in the coming days. Though certain correction and volatility can be observed along the way but as the price remains below 1.24 price area the bearish bias is expected to continue further.