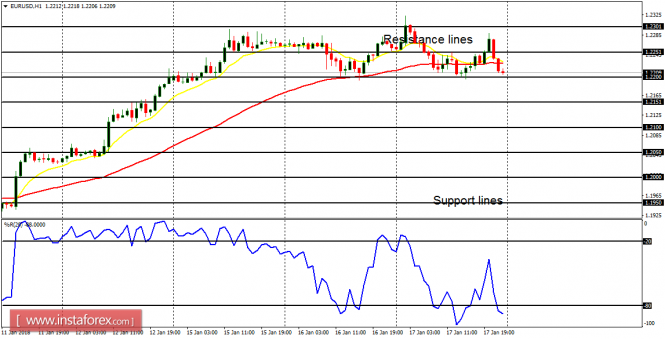

EUR/USD: This pair has consolidated so far this week, and it is possible that it would remain as such until the end of this week. A movement to the upside or to the downside is possible, but price would need to break the resistance line at 1.2200 or the support line at 1.2150. Normally, since the dominant bias is bullish, a movement to the upside is much more likely.

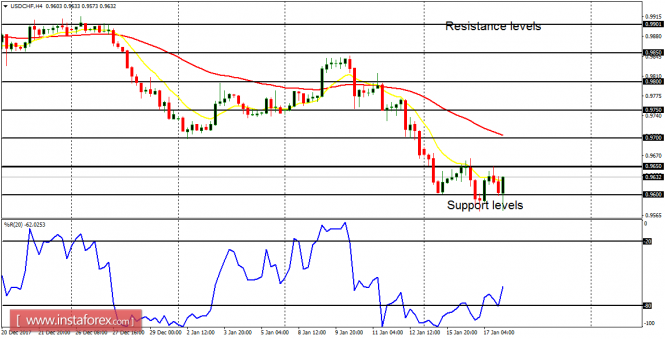

USD/CHF: The USD/CHF pair has consolidated so far this week, having gone bearish last week. The bias on the market is bearish, and when volatility returns to the market, it is much more likely that it would be in favor of bears. Some fundamental figures are expected today and they may have impact on the markets.

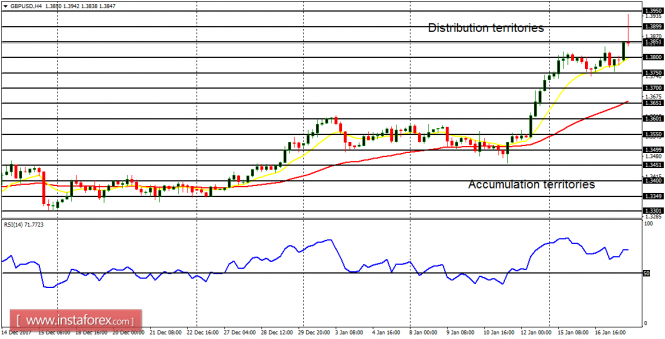

GBP/USD: There is a huge Bullish Confirmation Pattern on the Cable. Price has been making some bullish effort since last week, and it is possible that the distribution territories at 1.3850 and 1.3900, which had been previously tested, would be tested again. Price would even go beyond those distribution territories.

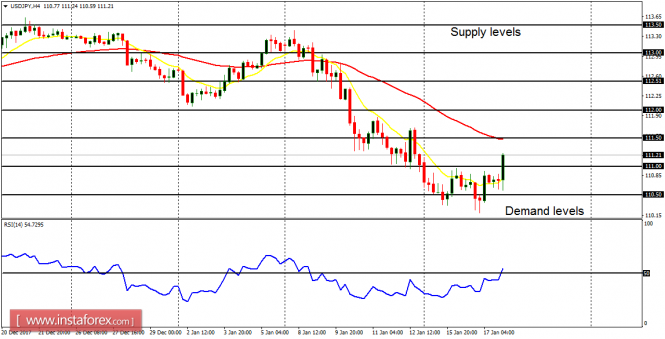

USD/JPY: This trading instrument has experienced an upwards bounce in the context of a downtrend. Unless the supply level at 112.00 is breached to the upside, the upwards bounce would turn out to be good opportunities to sell short at great prices. The demand levels at 111.00 and 110.50 could still be tested before the end of this week.

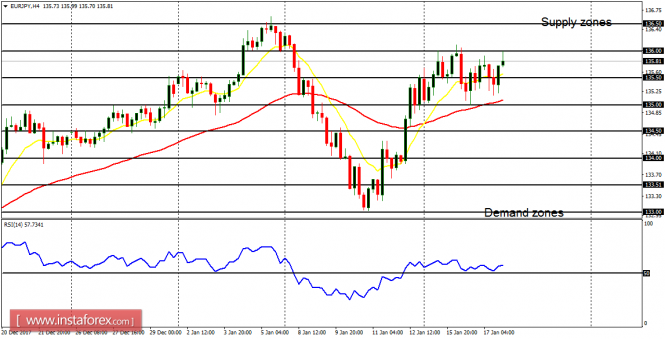

EUR/JPY: This market has been rough and choppy this week. Nevertheless, the bias on the market is bullish. The EMA 11 is above the EMA 56, and the RSI period 14 is above the level 50. The market may be able to reach the supply zones at 136.00, 136.50, and 137.00 before the end of this week. The supply zone at 136.00 has been tested and it would be tested again.