The dollar is making desperate attempts to stop the fall, but the result cannot yet be called as satisfactory. The pound has already faced all forms of declined since June 2016 while the euro has renewed a three-year high. Even the yen is trying to strengthen, as it is under pressure due to the general growth of raw materials and energy prices.

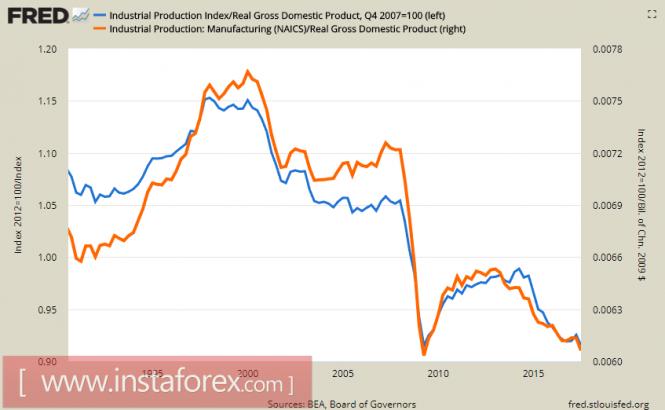

The dollar falls against the backdrop of the growth in the main indicators from the U.K. and the confidence of the players that nothing will prevent the Fed from sustaining the announced plan for normalizing the rate. The growth of industrial production in December was 0.9% which is a repetition of the best monthly result since May 2017. Although it must be admitted that for industrial production in the overall structure of US GDP continues to decline.

The "Beige Book" published on the eve also reflects a quite optimistic outlook on the economic outlook. There are difficulties in finding a skilled workforce, improving business conditions where almost all districts have noted the growth of the economy and hope for a rise in prices in retail and real estate.

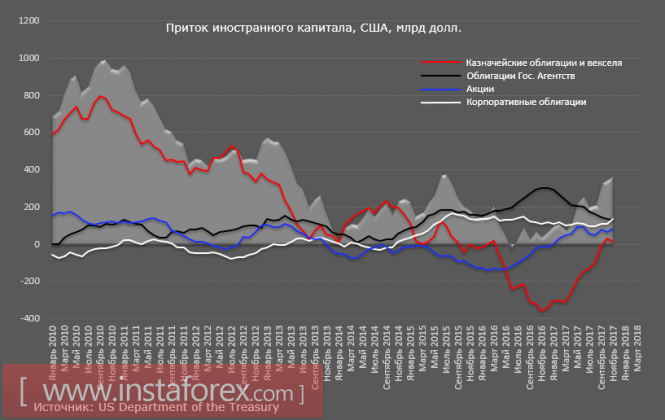

The Treasury reported on foreign capital flows through November indicating the trend is also confidently positive. The demand for treasury is again in the positive zone, and the capital inflow to the stock market contributes to record growth of stock indices.

As for the forecasts for the Fed rate, the market is almost certain the probability of the event of another increase will take place in March, according to the CME futures which are more than 75%. Confidence is facilitated by a slightly higher than expected inflation and a number of hawkish comments from the Fed leadership. Markets are also confident that this year the rate will be raised three times in the amount of 0.75%, and the Fed will retain the status of the most aggressively set up by the Central Bank.

There are first signs that Trump's team manages to turn the tide in its favor. Yesterday, Apple made a number of statements about investing in the US economy, guided by changes in tax legislation. Apple says that they will invest $ 350 billion in the US economy over the next five years, which will create 20,000 new jobs and pay about 38 billion in taxes. Moreover, Apple is likely to return most of its offshore funds to the U.S. and this is a very significant amount since the company had cash reserves of $ 252 billion, according to data for September 2017.

Apple, the first sign and in addition, the largest, would face the first fruits of the policy of repatriation of capital, which is persistently pursued by Trump as it starts to be enacted.

By all accounts, the dollar should be in high demand yet in practice, the situation looks exactly the opposite. The reason may be that markets cannot ignore the weak growth rates of real incomes of the population, which is reflected in the low growth rates of the average wage. Other factors include the reduction of the purchasing power of the population, and the main competitor of the USA, Europe, preferably. For example, car sales in Europe and the US have a multidirectional trend. In Europe, sales in 2017 reached a 10-year high, while in the US the year-to-year decline in the car market was recorded by the end of the year, which just indicates trends in real incomes are clearly not in favor of the US.

Of course, one must also bear in mind the anomalously severe freeze established in a large part of the US territory, which will inevitably lead to a decrease in retail sales and GDP growth rates in Q1 and as a result will put pressure on the dollar. Although, the dollar has no good reason to continue the decline in the long run. Factors such as inflation, budget deficit, repatriation of capital and new investment projects, will soon determine the demand for the dollar, which is likely to attempt a recovery in the coming days.

The material has been provided by InstaForex Company - www.instaforex.com