The AUD and NZD are the strongest on Tuesday with the help of local information. USD cooled the weekend enthusiasm associated with political factors. On other crosses, the movements were moderate. EUR / USD is up to 1.1870, USD / JPY is at 112.60. In the morning, the fresh pressure reaches GBP after yesterday's disappointment with the lack of progress in Brexit negotiations.

On Tuesday 5th of December, the event calendar is quite busy with important economic releases. Germany, Spain, Italy, UK and Japan will release PMI Services and PMI Composite data. Later in the day, the Canada will post Trade Balance data and the US will reveal Trade Balance, PMI Services, PMI Composite and ISM Non-Manufacturing PMI data. No speeches were scheduled for today.

EUR/USD analysis for 05/12/2017:

Monday's data from overseas gained secondary importance in the investors' opinion. The US session brought confirmation of rumors about the choice of Thomas Barkin, senior manager at McKinsey, for the post of chairman of the Fed branch in Richmond. The US Dollar has not come under the pressure of the above decision, because the market expects Barkin to sustain quite hawkish overtones characteristic of its predecessors. In the shadow of the announcement, there was a solid revision of the October factory orders, accompanied by higher orders for capital goods from outside the defense and air sectors, which give hope for building expectations for more substantial growth in the last quarter. With the current calibration of the newcast model, the market participants expect the US economy to end the year with annualized GDP growth at 3.7%.

Let's now take a look at the EUR/USD technical picture at the H4 time frame. The market has reversed from the technical resistance at the level of 1.1936 and now it looks like it is trying to make a triangle pattern. The key technical support remains at the level of 1.1807 and the bearish outlook is being supported by the weak momentum.

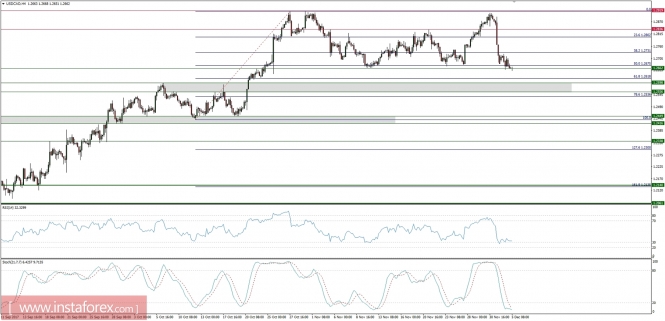

Market Snapshot: USD/CAD testing the key support

The price of USD/CAD is trading at the technical support at the level of 1.2662 and any violation of this level would lead to the decline towards the next technical support at the level of 1.2598. Nevertheless, some kind of bounce might be expected here as the market conditions are oversold. The nearest resistance is seen at the level of 1.2731.

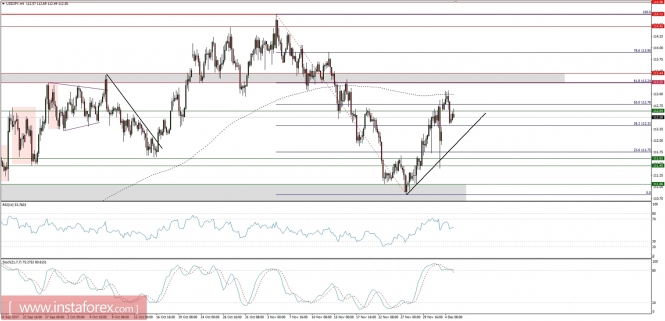

Market Snapshot: USD/JPY starts to decline?

The price of USD/JPY is having a problem to rally further above the 61% Fibo at the level of 113.24 and due to the overbought market conditions, the price might start to reverse towards the nearest support at the level of 112.32.