Trading plan for 10/10/2017:

The overnight currency changes are not big, but USD is the weakest major currency. The Dollar remains at a low level with EUR/USD rising to 1.1770. USD/JPY oscillates at 112,60, which is roughly where it was on Monday. Stock markets in Asia ignored Wall Street slumps, Gold held high, and Crude Oil drifted sideways.

On Tuesday 10th of October, the event calendar is light in important news releases. During the London session, Switzerland will release Unemployment Rate data, Germany will post Trade Balance data and Italy and France will present Industrial Production data, together with the UK. Later during the US session, Building Permits and Housing Starts from Canada will be posted and there is a speech from FOMC Member Neel Kashkari scheduled for the end of the trading day.

EUR/USD analysis for 10/10/2017:

The German Trade Balance data beat market expectations earlier this morning. The reading revealed was at the level of 21.6 bln euro, while market expectations were 20.1bln, a 1 bln more than a 19.1 bln a month ago. According to Federal Statistical Office (Destatis), Germany exported goods to the value of 103.1 billion euros and imported goods to the value of 83.0 billion euros in August 2017. German exports increased by 7.2% and imports by 8.5% in the August 2017 year on year. Compared with July 2017, exports increased by 3.1% and imports by 1.2% in the calendar and seasonally adjusted terms.

Trade Balance is one of the biggest components of Germany 's Balance of Payment. As Germany is Europe's largest economy and given Germany's export-oriented economy, trade data can give critical insight into pressures on the value of the Euro. The 20.1 bln trade surplus in September might help to lift the Euro higher across the board today.

Let's now take a look at EUR/USD technical picture on the H4 time frame. The market has broken above the Falling Wedge channel line and hit the technical resistance at the level of 1.1786. The upward momentum is rising and now the indicator is above its fifty level. Nevertheless, the key technical resistance zone between the levels of 1.1821 - 1.1847 is still not tested, so the market might continue the sideway move for some time now.

Market Snapshot: SPY made a Double Top?

The price of SPY (SP500 ETF) has made a top at the level of 254.68 and recently tested it again, which might be the first step for a Double Top formation. To confirm this scenario, the market must drop below the local technical support at the level of 253.43 and head towards the level of 251.37.

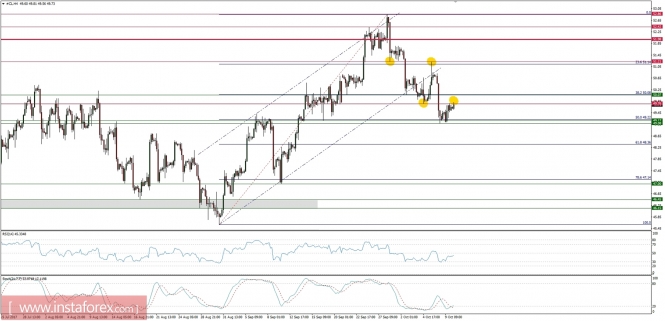

Market Snapshot: Crude Oil at resistance

The price of Crude Oil has bounced from the 50%Fibo support at the level of $49.22 and currently is test the last technical resistance at the level of $49.76. To continue downwards, the price must be capped at this level and head towards the 61%Fibo at the level of $48.36.