Despite the combined efforts of the Fed and the Trump administration, the US dollar was not able to complete the week with growth. It recoiled from the intermediate highs reached on Thursday.

The reason for such indecision of investors may be much deeper than the market is aware of. Until recently, players were very skeptical about the likelihood of another rate hike this year, as the Fed lost the main argument in the matter of rates because of the rising inflation. As you know, the Fed proceeds from the assumption that full employment will automatically ensure an increase in inflation. They believe that it will lead to an increase in the average wage and real population income. This position was repeatedly voiced by both the head of the Federal Reserve, Janet Yellen, and many other members of the Committee.

However, the latest data indicate that the process of increasing the population income is stalling. The PCE report showed that consumer spending growth slowed down in August where the growth was only 0.1% versus 0.3% in July, with inflation being accounted for the first time since January. The PCE Core index rose by 1.3% year-on-year which is worse than the forecast of 1.4%.

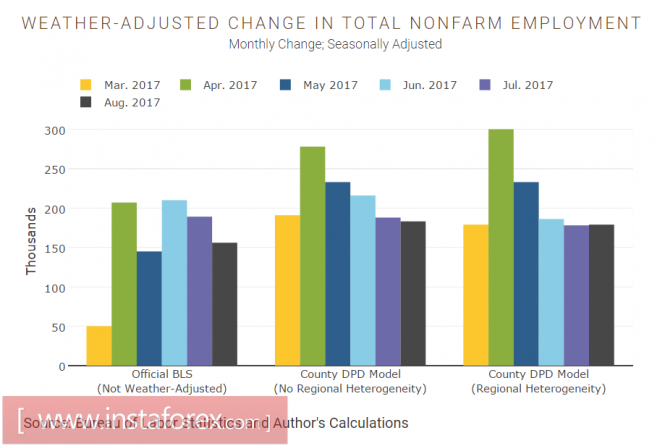

The reason may be the worse state of affairs for employment than what is considered. The graph below shows the result of the San Francisco FRB study, which compares the official growth of new jobs (left histogram) with the calculated, weather-adjusted, and seasonal data. Following from the calculations, the employment situation deteriorated for 4 consecutive months, which means that there is no reason to expect real income growth.

Thus, the main factor of confidence in the continuation of the growth of rates under threat is the assumption that there are no reasons for the return of inflation to the growth trajectory. Perhaps, this factor explains the cautiousness of investors and the muted demand for the dollar, which is still behind expectations.

The market will overestimate the Fed's ability to maintain the intended course. In early September, Deputy Chairman of the Federal Reserve Stanley Fischer decided to resign on October 13, as reported in a letter to US President Trump. On Saturday, it was reported that Trump will decide on a candidate for Fed chair head post within three weeks. So, Yellen's resignation after his first term looks almost settled. The Fed will significantly update the composition besides dealing with a new reality in the form of an amended fiscal law, which may require adjustments to monetary policy.

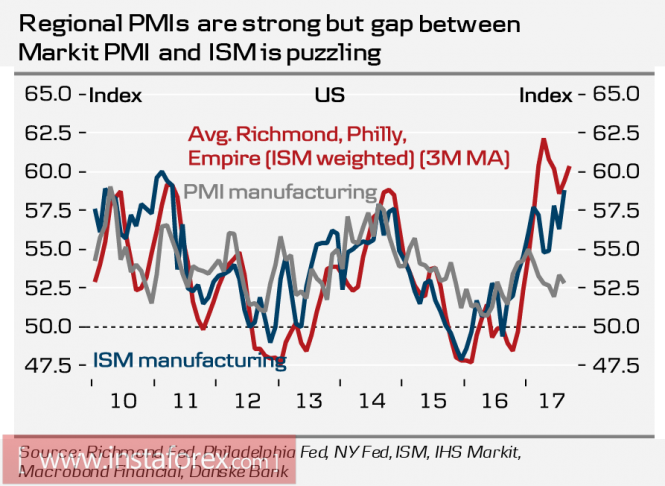

On Monday and Wednesday, there will be reports on business activity from Markit and ISM. Given that the regional indices rose steadily in September, we can expect that both indexes will support the trend towards confidence growth. As a result, the dollar will receive some support. Also on Wednesday, the speech of the head of the Federal Reserve, Janet Yellen, is scheduled.

On Friday, the employment report for September will be published. And given the slowdown, the growth in new jobs may be less than 100,000, which does not add points to bulls. Representatives of the Fed in recent weeks have repeatedly stated that they are ready for weak macroeconomic data and will not pay any special attention to them, since they are "connected with hurricanes". However, investors can argue differently because the slowing of the labor market will not give the chances to rising inflation. In this case, the dollar will lose the driver for growth.

Thus, the beginning of the week for the dollar looks quite optimistic, but in order to continue growing, it will need support in the form of good ISM indices and an employment report. The dollar will have an advantage against defensive assets, primarily against the yen. However, rising oil and the outlook for outpacing rates in Canada and the UK make the favorites of the week commodity currencies.

The material has been provided by InstaForex Company - www.instaforex.com