Eurozone

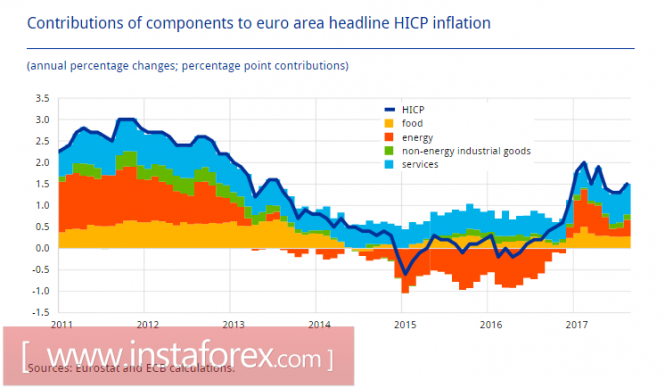

Preliminary data on consumer inflation in the eurozone for the month of September proved to be worse than expectations, depriving the euro of a chance to resume growth. According to Eurostat, the inflation rate was 1.5% with the forecast of 1.6%. Meanwhile, the basic index minus energy and food prices increased by 1.1%, which is much worse than 1.3% for the month of August. The overall structure of the index indicates that inflation is supported solely by price increases in the services sector. The share of the industrial sector is only 0.1%, which indicates the weakness of the consumer sector.

Today, the employment report in the euro area for the month of August will be published . The unemployment rate is expected to decrease from 9.1% to 9.0%, but the average wage growth, according to experts, will remain subdued and well below the historical average of 2.1%. The release of data, if it is no better than expectations, will confirm the trend towards deflationary pressure and push the probability of the stimulus program ending further into the future.

Also, the level of consumer activity can be estimated on Wednesday, when retail sales data will be released for the month of August. After a weak July (-0.3%), a moderate growth of 0.3% is expected. Deviation from the forecast in any direction can influence the euro exchange rate.

On Monday morning, the euro remains under pressure, with the probability of a decline to 1.16 remains high.

United Kingdom

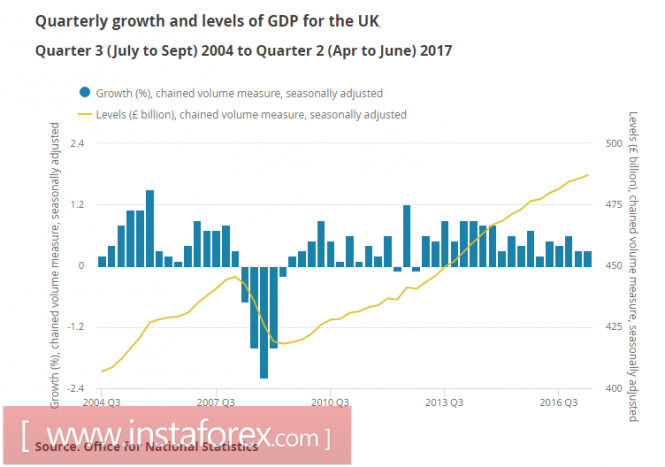

Friday brought a few positive news to the pound. In August, there has been a positive trend in consumer lending. After the failure in July last year, there is recovery, albeit not at a rapid pace. However, for the whole, the growth was quite confident. The total volume of commercial investments in the second quarter also turned out to be higher than expected. The growth was 0.5% with zero forecast and 2.5% year-on-year.

At the same time, GDP growth in the third reading was still adjusted downward from 1.7% to 1.5%. The dynamics remain weak. In fact, the GDP growth rates are the worst for 4 years, only in the services sector.

The head of the Bank of England, Mark Carney, confirmed on Friday a high probability to raise the rate at the meeting on November 2, provided that there is no data indicating the weakness of the economy. What is considered a weakness? Before the meeting of the Bank of England for another month, the pound, most likely, will take a pause because there are no clear reasons to resume growth.

Negotiations on Brexit will not be continued next month, despite the fact that the position of the UK has softened considerably. Too much of a complex of contradiction has been identified by the parties, and pro-expert approaches will not find new approaches. News from this side should not be expected.

On October 1-4, the congress of the Conservative Party in Manchester, which is in a weakened state after the June elections, will convene. There are more specific comments on the state of the British economy from Therese May.

On Monday, Markit will present data on business activity in production and service sector. Expectations are currently neutral. Reduction in the GBP/USD pair is slightly more likely. The immediate goal of bears is support for 1.3113.

Oil

Confident oil growth creates prerequisites for technical correction, and the growing likelihood of strengthening the dollar will help to reduce it. At the same time, the growing demand and confident control over production by OPEC + will help Brent quotes stay above the support zone of 55.40 / 90.

The material has been provided by InstaForex Company - www.instaforex.com