The dollar reacted with a decline in the Wednesday night's release of the minutes of the FOMC meeting of September 20. Investors were disappointed by the cautious position of Cabinet members and fears that the period of low inflation in the US economy could drag on.

A one-time rate increase by the end of this year can be considered a matter of solved, on this issue, there is almost a consensus. However, the prospects for the next step in March are now in question, since fears of inflation may force FOMC to postpone another increase until the summer.

Nevertheless, these fears are limited and are unlikely to prevent the dollar from continuing to strengthen.

Eurozone

An impressive landing of the ECB leadership landed in the United States to attend the annual meeting of the World Bank and the IMF. Today in Washington, ECB President Mario Draghi is expected to speak, the members of the board of Pratt and Kere will assist him, tomorrow Lautenschlager and Constantio are expected. Judging by the stated topics of the reports, the ECB management proposes to disclose in detail its vision of the macroeconomic situation in the world and in the euro area, and also intends to substantiate the methods of the monetary policy being pursued. The market may respond to ECB members' comments by increasing volatility, as there is as yet no consensus on the curtailment of incentive policies.

The euro got to the resistance of 1.1880, however for the development of traffic, it needs a new driver. Given the expected markets for positive news from the United States, it seems preferable to sell EUR/USD from the current levels in order to re-test 1.1660.

United Kingdom

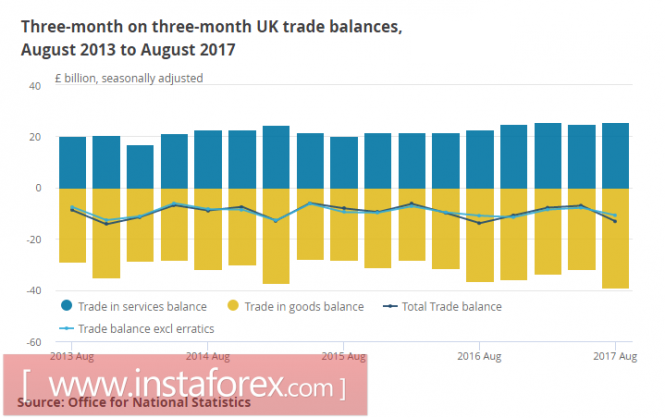

The weak pound led to several rather unpleasant consequences for the British economy. The trade deficit in August renewed the record again, increasing by 1.4 billion pounds, and even a slight increase in the trade balance in the services sector could not compensate for a marked decline in trade in goods.

The growth of industrial production slowed somewhat in August, one of the main reasons is the reduction in the oil and gas sector.

Negotiations on Brexit run into a layer of insoluble contradictions, officials on both sides of the English Channel differently see the process of divorce. Some of the British parliamentarians are calling for the development of an exit plan from the EU without an agreement with the European Union, that is, unilaterally, and begin with the strengthening of customs and migration legislation. Such steps can lead to a full-fledged trade war, and, of course, it would be in the interests of the parties to avoid such a scenario, as the British Finance Minister Hammond called yesterday when speaking in Parliament.

At the same time, the true causes of Brexit begin to manifest themselves. As British Trade Minister Liam Fox said on Wednesday, Plan B envisages, as an option, the accession of Great Britain to the North American Free Trade Agreement (NAFTA), which includes the US, Mexico, and Canada. The market is still skeptical of such statements, considering them rather a way of pressure on partners than a real action plan, but in a pound/euro pair, the pound's prospects are higher if events develop in a negative scenario.

Given the lack of serious macroeconomic news before the end of the week, the pound movements will be of a technical nature, unless, of course, today's comments by one of the Governors of the Bank of England Hammond will not give rise to a reassessment of risks.

The pair EUR/GBP, after failing at the second attempt to overcome the resistance of 0.8990, probably a decrease to 0.8870 / 80 with a subsequent attempt to update a minimum of 0.8750. Against the dollar, the pound's rise is corrective, a new wave of decline from current levels is possible, the medium-term target is 1.2930 / 70.

Oil and the ruble

The oil price was adjusted after the publication of the weekly API report, according to which oil reserves in Cushing increased by 3.1 million barrels, growth is observed for the seventh week in a row and is a bearish factor. At the same time, gasoline inventories declined by 1.58 million barrels, so the decline in quotations was limited.

OPEC, in turn, reported on production in September. Judging by the published figures, OPEC members have withstood their obligations to reduce production, which allows us to hope that the work on the new agreement takes place in a constructive manner. Moreover, OPEC has found the strength to appeal to oil producers with a call to "take on a part of responsibility," which is more evidence of the strength of OPEC at the moment rather than weakness.

The growth of oil is limited by a period of the temporary weakening of the dollar. To continue the growth of the reasons for the fundamental nature is not enough, as long as the trade in the range and the expectation of a new driver is likely.

The ruble continues to trade in the sideways range, the exit from which is more likely to be marked by a new wave of strengthening the Russian currency. Fixing USD/RUR below 57.40 will open the way to 56.70 with the subsequent attempt to develop the offensive.

The material has been provided by InstaForex Company - www.instaforex.com