After a prolonged fall in September, gold returns to the game and grows over three trading sessions in a row amid growing uncertainty around North Korea and Catalonia. Russian officials assured that it is ready to launch a long-range missile after the visit to Pyongyang. Moreover, the President of Catalonia signed the Declaration of Independence. Simultaneously, Catalonia postponed its own action with the purpose of negotiations with Madrid. All of these bring confusion to the market and increase the demand for safe haven assets. On the hand of the "bulls" of the XAU / USD pair, the correction of the US dollar rate in the first half of the autumn will also be a factor.

It is the weakness of the dollar, due to the disappointment with Donald Trump's policy and the lack of confidence in the third increase in the federal funds rate in 2017, that allowed the precious metal to soar to its maximum mark for the year. Nevertheless, the joy of the "bulls" was short-lived. The tax reform which was brought to public attention, the return to the markets of the idea of reflationary trade, and the growing probability of the Federal Reserve's monetary policy tightening in 2017, caused gold to lose about 6% its value from 31% to 88%. The situation painfully resembles the one that emerged after the presidential elections in the US last autumn. Then the faith of investors in the dispersal of the US economy to 3% lowered the price of XAU / USD by 10%. Is history repeating itself?

Dynamics of gold and the US dollar

Source: Financial Times.

The "bulls" believe that this is not so. In their opinion, it's extremely reckless to talk about restoring the uptrend on the USD index. The indicator reached a 14-year high in early 2017 due to the divergence in the monetary policy of the Fed and other central banks issuing currencies for G10. Currently, the acceleration of the global economy to 3.6-3.7% (the IMF forecast for 2017-2018), the victory over deflation, and the improvement of the situation in labor markets around the world created a solid foundation for raising rates in other countries. Yes, gold plunged into an unfavorable environment for itself, when the Fed is turned a blind eye to sluggish inflation and continued the cycle of normalizing monetary policy. This led to an increase in the real yield of bonds. However, Washington has repeatedly stressed its desire for a slow process of monetary restriction, and Donald Trump does not hide that he is a supporter of low interest rates and a weak dollar. This allows us to hope for the recovery of the upward trend in the XAU / USD pair to overcome the $ 1400 per ounce mark in 2018.

The "bears" in gold, by contrast, believe in a happy resolution of the conflicts around North Korea and Catalonia, and the situation in the US economy. If the GDP really accelerates to 3%, then the Fed can raise the rate with a clear conscience to 2.75% or higher. This is because the faster the GDP, the more cost-effective the investment projects should be.

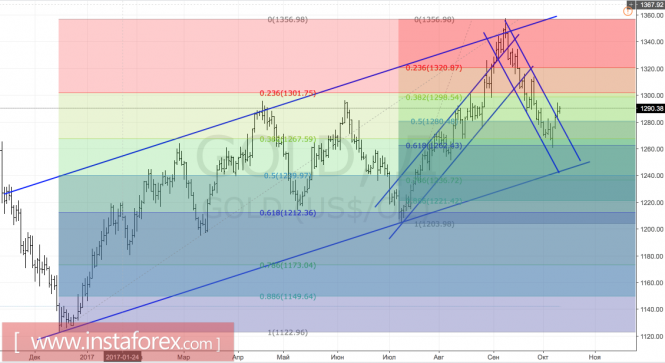

Technically, the breakthrough of the upward trading channel returns the hope of restoring the "bullish" trend in precious metals. Nevertheless, in order to confirm the seriousness of their intentions, buyers should take by storm the resistance at $ 1298-1302 per ounce and keep the quotes above it.

Gold, daily chart