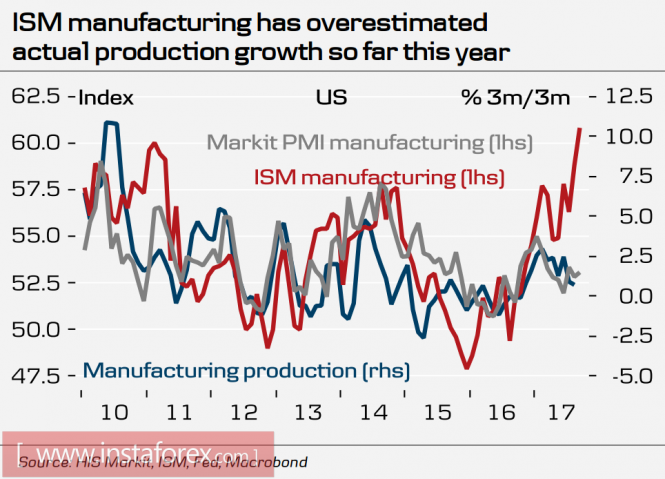

Published on Monday, the ISM report on activity in the manufacturing sector gave absolutely striking figures. The index for September reached the level of 60.8p, which is a historical record since May 2004. Similarly, the Markit index is more modest and correlates compared to the ISM that shows the index of index production. The gap between the Markit and the ISM is too large to ignore and reflects the imperfection or even the bias of the calculation methods, rather than the real recovery of the US economy.

Markets reacted to the strong data as the S&P 500 index set yesterday reaching the next historical record of 2534.98p, closing the day near the maximum. The stock market grew as the expectations are implemented regarding the prospects for the forthcoming fiscal reform. Moreover, the prospect of reducing the tax burden attracts investors even under the threat of tightening financial conditions.The dollar in such a situation will be in high demand, which is certainly a bullish factor.

The employment report for September will be published on Friday. This is a significant increase in the value of both wages and salaries. However, the expected report may be significantly worse than the previous one. Primarily because of the hurricanes. Currently, it is projected that the number of new jobs will be reduced to 98,000 while the average wage growth is not expected to change to 2.5 percent.

Growth in the course of time, and in the course of time. Here the role of the Federal Reserve plays a role, this directly implies that the consequences of decisions on the monetary policy.

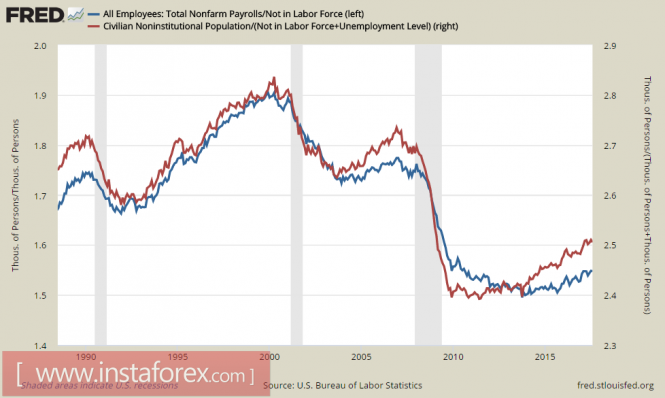

Market expectations are largely shaped by the position of the Fed. Also, it should be noted that labor market recovery becomes a marketing term since the real situation is much worse which is clearly demonstrated in the graph below. The ratio of the volume of jobs (Total Nonfarm Payrolls) to the number of workers leaving the labor force since 2011 is almost invariably and much worse than the pre-crisis period. The labor market gives off a similar picture to the potentially active population to the number of unemployed is in fact in a much worse state than in the pre-crisis period.

The following statements can be concluded based on the above: There is no real basis to ensure that the high employment will ensure the growth of inflation according to the rhetorics of the Fed. It just forms market expectations, which is expressed in the willingness of investors to support the growth of the stock market and generally contributes to strengthening the position of the dollar. However, the long-term position cannot clearly justify the stock market. The rate hike in December, as well as the beginning of the Fed's contraction of the balance sheet, will help tighten financial conditions and increase deflationary pressure. In these conditions, there will be more demand for the dollar and the currency will objectively become more expensive.

Today, the ADP report on employment in the private sector for September will be published and probably the number of jobs will have a sharp decrease. Taking into account the decline of prices, it will cause a market reaction in case of a noticeable discrepancy with the forecast. Also, pay attention to the ISM report on activity in the services sector, the forecast is moderately positive. The result is not worse than expected which supports the dollar. An important event of the day is a speech by Janet Yellen at a conference in St. Louis, where she is expected to give her assessment on the state of the U.S. economy in the light of the planned tax reform.

Reduction of commodity prices, primarily oil and gold, as well as expectations of the beginning of the tax reform are pushing investors to shift into dollar assets. Market expectations are optimistic and investors are not inclined to pay attention to the threat of growth of deflationary pressure. On the contrary, they suggested during the rotation of FOMC members that President Trump will eventually create a more aggressive team that will pursue a more stringent monetary policy.

There should not be any active actions until Friday but the weakening must be considered temporary. Hence, this can be taken into an advantage and enter long positions. In general, the market environment continues to be favorable for the dollar.

The material has been provided by InstaForex Company - www.instaforex.com