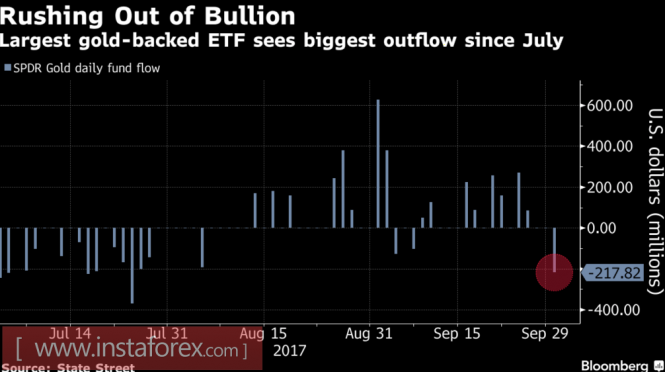

Working with gold traders in the fall throws something in the heat, then in the cold. Dragmetall in early September against the backdrop of escalating geopolitical risks, seasonal purchases and the weakness of the US dollar reached its highest level for the year, but could not hold above $ 1,350 an ounce and the stone collapsed. Participants in the market battle little verbal skirmish between Washington and Pyongyang, they need action. In this regard, the words of US Secretary of State Rex Tillerson that the States are wasting time to negotiate with North Korea, which caused the most serious outflow from the largest specialized stock fund SPDR Gold Shares over the past couple of months are indicative.

Dynamics of capital flows in SPDR Gold Shares

Source: Bloomberg.

Do not particularly believe in the prospects of XAU / USD and retailers. For the first 9 months of this year, the volume of sales of investment coins by the American Court declined by 2/3 compared to the same period of 2015 and 2016. Speculators cut the net long positions in gold at the fastest pace since the beginning of July (-16%), while JP Morgan recommends His clients stay in shorts for precious metals.

The main culprits of all ills are the "bulls" called the tax reform and the growth of the probability of tightening the monetary policy of the Fed. The December indicator jumped from 31% to 83% after the rumors in the press that the next head of the Federal Reserve would be Kevin Warsh. In 2011, he resigned from the FOMC in connection with the disagreement over the policy of cheap money. If the head of the Central Bank becomes a "hawk", then the probability of three acts of monetary restriction in the next 12 months will rapidly go up the hill, which will support the US dollar and the yield of treasury bonds. At present, the indicator is about 25%.

For gold, there is nothing worse than a strong "American" and a rally in the rates of the US debt market. It is not able to compete with bonds and is sensitive to changes in their profitability. However, some central banks do not panic about this. For example, the Russian regulator continues to buy up precious metals at the same rate as in 2015-2016 (approximately 200 tons). Its gold reserves are estimated at 1716 tons, which is equivalent to the sum of the indicator for Turkey, Mexico and India and is about 17% of the gold and foreign exchange reserves of the Russian Federation.

In the short term, bulls for XAU / USD may receive some support due to the disappointing report on US employment for September and the hawkish rhetoric of the minutes of the last meeting of the Governing Council of the ECB. The European regulator is very careful in preparing the markets for the normalization of monetary policy, step by step leading them to the need to fold QE.

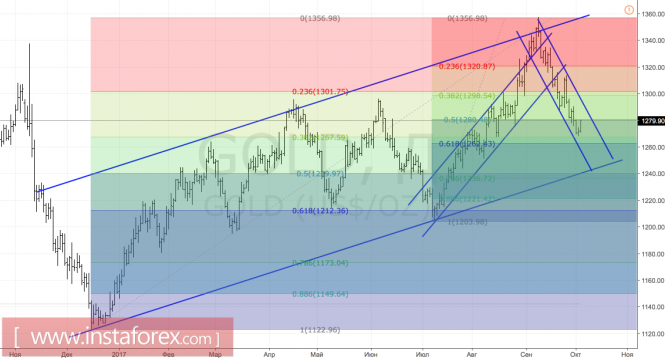

As for the report on the US labor market, the weak expectations (+80 thousand for non-farm payrolls) are related to the impact of hurricanes on the economy. A technically successful storm of resistance at $ 1,280 per ounce will allow the bulls to create a foundation for future consolidation in the $ 1265-1320 range. If the test is unsuccessful, the risks of continuing the southern campaign will increase.

Gold, daily chart