The US dollar was sold at the close of the week on Friday after an unexpectedly weak report on retail sales and industrial production for the month of August. The data cast doubt on the prospects for the recovery of the US economy.

Retail sales decreased by 0.2% compared to July. Moreover, the July growth of 0.6% was revised downwards to 0.3%. Meanwhile, the report for June was a;so revised from + 0.3% to -0.1%. Thus, the dynamics of retail sales over the past three months was significantly worse than the market expected, casting doubt on the ability of the US consumer sector to maintain demand at the same level.

For the first time since January, the volume of industrial production has decreased. The decline in August was 0.9%, which is the maximum monthly decline since May 2009, causing the manufacturing industry fell by 0.3%. The reason for such a weak data, according to experts, is the consequences of hurricane "Harvey", which broke out on the southern coast of the United States and contributed to a decline in the oil refining and chemical industries.

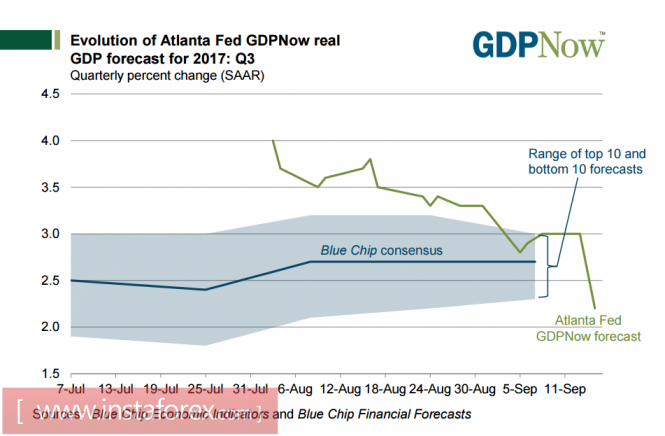

The GDP growth rate in the third quarter was now under attack. The GDPNow model from the Atlanta Federal Reserve forecasts an increase of 2.2% in the third quarter, which is noticeably worse than the 4% growth expectations of just 6 weeks ago. Meanwhile, weak economic growth casts doubt on the Fed's plans to normalize monetary policy.

The failed report on retail sales was unexpected given the acceleration in consumer price growth. In August, inflation rose by 0.4% against a growth of 0.1% for the month of July. Year-on-year growth reached 1.9%. The results were better than forecasts and, it would seem, gave a strong argument for the bulls on the dollar. Good dynamics on consumer activity would add credibility to the leaders of the Fed. This is because after the start of the program to reduce the balance sheet following the meeting on September 20, the market considered the matter resolved,and the dollar should have receive the long-awaited impetus for a turn.

However, the dollar's fate is again in question. Of course, the dynamics of retail sales is unpleasant news for the Fed but it will not affect its position. The plan to reduce the balance sheet was announced in advance and the impact of the hurricane will have be temporary. However, the increase in inflation is a much stronger argument, and it will give an opportunity in the updated forecast of September 20 to indicate higher figures than the market expects.

The weakening of the dollar by the end of the week was also caused by the unexpectedly aggressive position of the Bank of England, which announced the imminent start of the rate hike cycle, and fixing profits before the weekend. At the same time, there is a noticeable recovery in the markets, which is reflected in the growth in demand for risky assets with stock indices growing. The dollar is experiencing a clear deficit of good news, and the beginning of the week before the Fed meeting will be held in anticipation of the positive outcome of the meeting.

At the moment, the dollar is ready to resume growth. All the catalysts for its decline in the current year are already played by the market. There are no new catalysts and there are very few reasons for further weakening. The problem with the level of public debt and government funding is removed from the agenda. The fate of the tax reform is in the hands of the democrats with whom Trump, according to recent data, has managed to find a solution that suits everyone. Any announcement of support for reforms by the Congress will serve as a powerful driver for the growth of the dollar, as it will potentially contain the factor of a rapid inflow of investments into the US economy.

The dollar has good chances, primarily against the yen and the franc. The Central Bank of Japan and the NBS continue to adhere to a soft monetary policy, which, against the backdrop of growing interest in risk, will be an additional argument in favor of sales. Against the euro, the dollar does not yet have strong positions, as the ECB is also preparing to wind down the buyback program. However, the euro's rise before the Fed meeting is virtually ruled out. Trade in the Australian and Canadian dollars will be cautious, with greater chances to go into the lateral range, at least until the support from rising commodity prices ceases.

The material has been provided by InstaForex Company - www.instaforex.com