Trading plan for 18/09/2017:

The first hours of the new week do not bring clear changes to the market. In the currency market, NZD and CAD are the strongest, reflecting a positive outlook for risk. In spite of this, changes to the USD are not high. EUR/USD is stable just under 1.1950. USD/JPY is testing seven-week highs around 111.30 as growth is supported by rising yields of the US 10-year-notes (2.20%). There is no sign of risk aversion on the Asian stock market - Nikkei is up 0.5% and Hang Seng gains 1.1%.

On Monday 18th of September, the event calendar is light in important economic releases, but market participants will keep an eye on Consumer Price Index data from the Eurozone and German Bundesbank Monthly Report. During the US session, Canada will publish Foreign Securities Purchases data and the US will post NAHB Housing Market Index data.

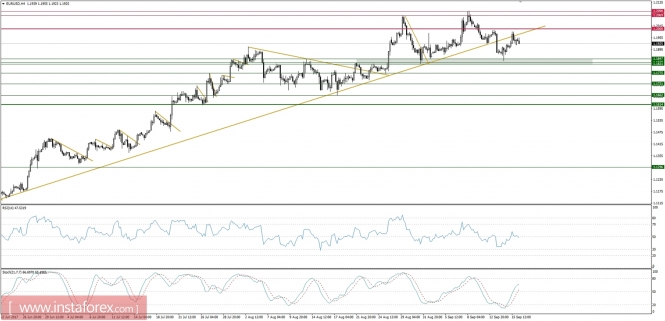

EUR/USD analysis for 18/09/2017:

The Consumer Price Index data from the Eurozone are scheduled for release at 09:00 am GMT and market participants expect no change in inflationary pressures. The CPI is expected to be released at the level of 1.2% and the Core CPI at the level of 1.5%. The lack of the inflationary pressures is adding more to the indication, that the European Central Bank will hardly decide to hike interest rates soon, but it is more likely to first decrease the amount of quantitative easing. The first hint of that decision had hit the newswires late Friday when the Bloomberg agency posted news indicating a possible 15bln Euro target of the asset purchase program in 2018. This would be the first step to normalize the monetary policy by ECB and could send the Euro higher across the board even on the larger time frames.

Let's now take a look at the EUR/USD technical picture at the H4 time frame. The market is trying to bounce from the oversold conditions, but the technical resistance at the level of 1.2000 still hasn't been hit. The momentum indicator broke above its fifty level, but now is going down again, which might indicate the bull camp is not strong enough to continue the bounce. Any violation of the gray support zone between the levels of 1.1821 - 1847 will directly expose the level of 1.1775 for a test. Longer-term bias remains bullish, but there are mounting signs of a corrective cycle coming.

Market Snapshot: USD/JPY breaks above key resistance

The price of USD/JPY has broken above the key resistance at the level of 111.04 and above the 50%Fibo at the level of 110.90. Currently, the price is trying to hit the 61%Fibo at the level of 111.75, but there are first signs of a building bearish divergence at this time frame, so a reversal might be expected around this level.

Market Snapshot: Gold at the key trend line support

The price of Gold deteriorated further from the recent swing high at the level of $1,353 and currently is testing the long-term trend line support around the level of $1,315. If the bears manage to break out below this trend line, the next technical support is seen at the level of $1,308.