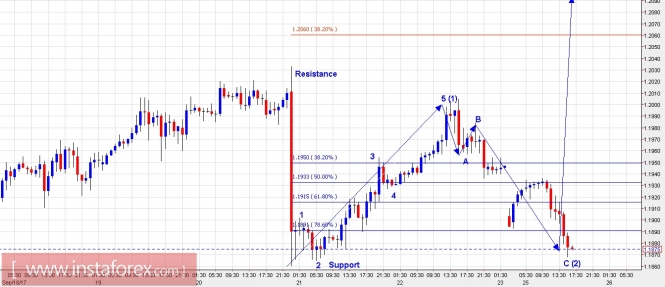

Technical outlook:

We are now entering into the last trading week for September 2017 and the trade setups are looking both promising and exciting for coming months. A short term chart has been presented with the most probable wave count in EUR/USD today. If you look at the counts here, an impulse wave (1) has been followed by a corrective wave (2) as labelled here. If this count proves to be true, prices should remain above 1.1860 levels and a quick wave (3) should be produced, followed by waves (4) and (5). This rally could take prices above 1.2100 levels easily and then reverse sharply lower towards the larger trend. Immediate support is seen at 1.1860 levels, while resistance is at 1.2090 levels respectively. On the flip side, a break below 1.1860 levels from here would prove extremely encouraging to bears.

Trading plan:

Aggressive traders should look to go long now, with stop below 1.1860, target at least 1.2100 levels.

Conservative traders please remain flat for now and look to go short above 1.2100 levels.

GBP/USD chart setups:

Technical outlook:

The GBP/USD short-term wave count has been presented here, as we are approaching the last trading week for this month. A shorter-term wave count suggests there is still some upside left in GBP/USD before it looks to reverse lower again. The rally from 1.3440 through 1.3570 looks to be an impulse labelled as wave 1. The subsequent drop is in three waves labelled as wave 2. A bullish reversal here would confirm that the next probable move is on the north side towards 1.3650 levels at least. For this count to hold true, prices should remain above 1.3440 levels for now. Please note that this could be the last leg rally before GBP/USD reverses lower in a big way towards the larger down trend. The upside should be limited towards 1.3700/50 levels in this rally, with resistance in place at 1.3650/55 and support is seen through 1.3440 levels respectively.

Trading plan:

Aggressive traders could remain long for now with risk below 1.3440, target 1.3650 levels at least.

Conservative traders should remain flat for now and look to sell at higher levels.

Fundamental outlook:

Please watch out for ECB President Mr Draghi's speech at 09:00 AM EST today.

Good luck!

The material has been provided by InstaForex Company - www.instaforex.com