Trading plan for 05/09/2017:

Another report of possible North Korean missile tests again dominated the mood on the financial markets and brought risk aversion moves. The JPY and CHF are the strongest major currencies, Gold is gaining as well. The Reserve Bank of Australia did not surprise by the decision or the announcement, but the AUD is a bit stronger after the published data.

On Tuesday 5th of September, the event calendar is busy with important news releases. The London session will be dominated by a set of PMIs releases (services and composite) from across the Eurozone. Moreover, Switzerland will post the Gross Domestic Product data. Later on, during the US session, Canada will post Housing Starts data and the US will post Factory Orders data.

EUR/USD analysis for 05/09/2017:

The PMI Services and Composite data are scheduled for release during all early morning. The latest news from the Eurozone economy was good and showed the ongoing steady pace of growth with elevated levels of business and consumers sentiment. This is why the PMI data are expected to be released in line with or better than investors' expectations. All the PMIs, regardless of the sector, are still above the fifty level that separates the expansion from contraction. So only a huge, unexpected slide to the downside in data would impact the Euro currency across the board.

Let's now take a look at the EUR/USD technical picture on the H1 time frame. The market bounced up from the dashed trend line again, but the sideway move looks corrective in nature. The volatility is currently limited and the weekend gap still hasn't been filled yet. The technical support zone between the levels of 1.1817 - 1.1865 is still the most important zone for the bulls. Any violation of this zone would likely lead to a test of the recent swing low at the level of 1.1662.

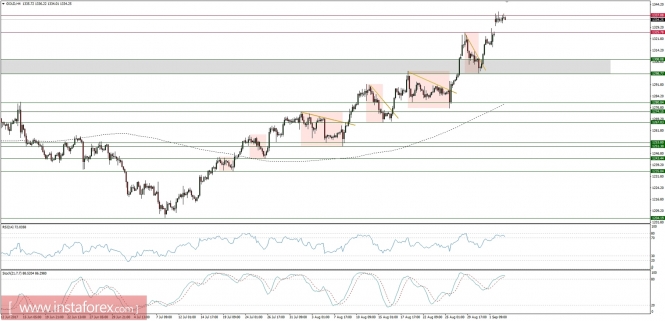

Market Snapshot: Gold still at swing highs

The price of Gold is still consolidating the recent gains at the swing high levels of $1,338. Due to ongoing geopolitical tensions, the weekend gap hasn't been filled yet and the technical support at the level of $1,325 hasn't been tested as well. Nevertheless, it is worth to mention that the bearish divergence between the price and the momentum oscillator has been reflected in this time frame. It suggests that the corrective cycle can occur anytime soon.

Market Snapshot: USD/CHF locked inside the horizontal zone

The price of USD/CHF has been trading close to the recent swing lows at the level of 0.9426, but bounced strongly last week, leaving a hammer candlestick pattern. Nevertheless, the bulls were not strong enough to break out above the technical resistance at the level of 0.9772, which is the key level to the upside. Currently, the market is trading in the middle of a range, but might slide to the downside as soon as the geopolitical tensions will escalate further.