The US dollar finished the week with a decline, failing to find a positive driver from the published macroeconomic data, as political risks in the eyes of investors clearly have a higher price.

According to the US Department of Commerce, personal spending rose in July at the highest rate since February, and incomes - at its highest since April. These data are positive for the dollar and indicate a resumption of consumer activity. At the same time, the price index of spending on personal consumption has not changed, indicating weak inflationary pressures and endangering the Fed's plans to raise the rate again this year.

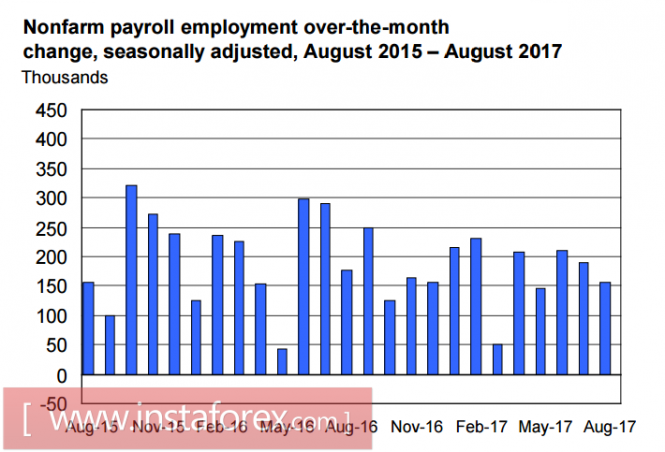

The growth in the number of new jobs in the non-agricultural sector of the US slowed to 156, 000 in August from 189, 000 a month earlier. The result was significantly worse than expected, but still reflects a strong job market recovery. After the decline of unemployment to 4.3% and achieving, according to the Ministry of Labor, full employment, the pace of creating new jobs should objectively slow, so the August result can not be considered negative and will not affect the Fed's plans.

More important is the weak increase in average wages, which was able to show an increase of just 0.1% against 0.3% in July, and this is less than the expected + 0.2%. The annual growth rate of average earnings is 2.5% for 5 consecutive months, and the dynamics as a whole looks rather weak, since it does not allow to give a positive outlook on the growth of inflation.

In general, the growth of the US economy does not cause concern. The GDP growth rate for the 2nd quarter was revised from 2.7% to 3.0%. PMI Markit index in the manufacturing sector increased to 52.8p in August, while the same index from the ISM shows a record growth of 58.8p, which is the highest since November 2014. While there is a slight decrease in the level of consumer confidence from 97.6 to 96.8p, according to the University of Michigan, it reflects the likelihood of escalating political risks, and not fears of citizens for their financial well-being.

Thus, the Fed faces only one macroeconomic hurdle: low inflation. It may prevent the Fed from raising the rate in September and postpone this move until December, but it does not prevent the plan to begin a reduction in the balance sheet.

US Treasury Secretary Steven Mnuchin said last week that the preparation of the tax reform is in full swing, as the reform plan is being distributed to members of the Congress, and its deliberation is planned before the end of this year. On Monday, Congress comes out of vacation, and there may be comments by Congressmen on the prospects for reform, which can cause additional volatility of the dollar.

The Congress will have to solve many other pressing problems. There is the matter of September 29 - the deadline for approval of a new ceiling of the national debt. Without the resolution of this issue, the budget for the new 2018 fiscal year can not be approved. Mnuchin has already rushed to announce that the period of debate of the issue of state debt can be shifted to October due to the growth of unplanned expenses related to Hurricane Harvey.

Thus, political risks and uncertainty on key issues, such as tax reform, the debt ceiling and the budget for the new financial year, do not allow bulls to seize the push in the dollar. On Monday in the US and Canada, due to the banking day off, trading activity will be low. On Tuesday - there is the publication of the report on production orders in July. On Wednesday, there is a need to pay attention to the ISM index in the service sector. Also, the impact of refined estimates of Hurricane Harvey's damage on the economy on the mood of investors will be seen.

The dollar will remain under pressure. The growth of gold last week was primarily due to fears of further weakening of the dollar, since the head of the Federal Reserve, Janet Yellen, during the Jackson-Hole meeting, did not give a single strong signal, and until the new statements of Committee members, the bulls will have nothing to rely on. Pay attention to the speech on Friday the head of the Federal Reserve Bank of New York, William Dudley, who is considered very influential in terms of developing the monetary policy of the Fed.

The material has been provided by InstaForex Company - www.instaforex.com