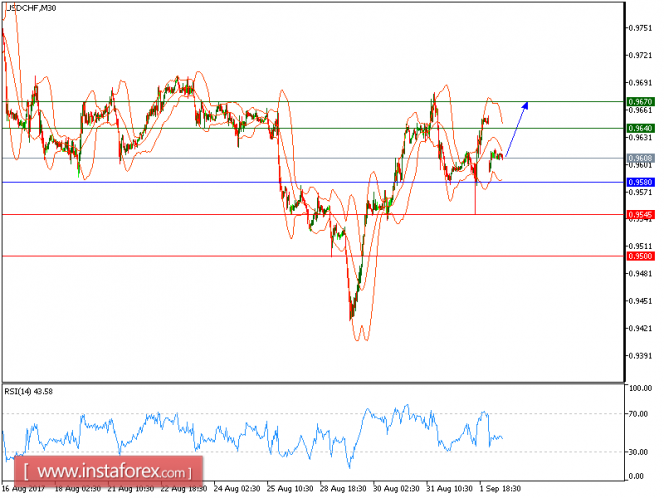

USD/CHF is expected to trade with bullish outlook as the pair is expected to continue the rebound. Although the pair broke below its 20-period and 50-period moving averages, a support base at 0.9580 has formed and has allowed for a temporary stabilization. Even though a continuation of consolidation cannot be ruled out, its extent should be limited.

The U.S. Labor Department reported that the economy added 156,000 nonfarm payrolls last month, compared with an addition of 180,000 jobs expected and 209,000 in July. The jobless rate ticked up to 4.4% from 4.3%, while average hourly earnings rose 0.1% after advancing 0.3% in July, keeping the year-on-year gain in wages at 2.5% for a fifth consecutive month. Meanwhile, the Institute for Supply Management (ISM) said its Manufacturing PMI rose to 58.8 in August from 56.3 in July.

Therefore, above 0.9580, look for a further rebound to 0.9640 and even to 0.9670 in extension.

Chart Explanation: The black line shows the pivot point. The present price above the pivot point indicates the bullish position, and the price below the pivot points indicates the short position. The red lines show the support levels and the green line indicates the resistance levels. These levels can be used to enter and exit trades.

Strategy: BUY, Stop Loss: 0.9580, Take Profit: 0.9640

Resistance levels: 0.9640, 0.9670, and 0.9715

Support levels: 0.9545, 0.9500, and 0.9475

The material has been provided by InstaForex Company - www.instaforex.com