The British pound managed a rapid counterattack against the US dollar due to the fiery speech of Janet Yellen in Jackson Hole. Yellen did not say anything negative about the American currency which is also not necessary. Investors took the GBP/USD quotes and there were hints of risk against the third hike in the federal fund's rate for this year. After these are not mentioned in the speech of Fed Reserve Chair, it began to massively discard the US dollar. According to Reuters, the net speculative position of the "American" has increased to $9.4 billion.

The main reason for the bears' struggle with the GBP/USD is political risks. The inability of Donald Trump to implement his campaign promises turned into a sudden collapse of the USD index. At the same time, fears over Brexit were muted which shifted the focus of the market's attention towards the growth rates of the economies of the two countries, along with the possible rate increase of the Bank of England and the Fed. In this respect, the positive reasons for the pound correction include the slowest growth in the GDP of Foggy Albion among other G10 currency issuing states, as well as, the reduction of chances in the 20% monetary restriction of the BoE this year.

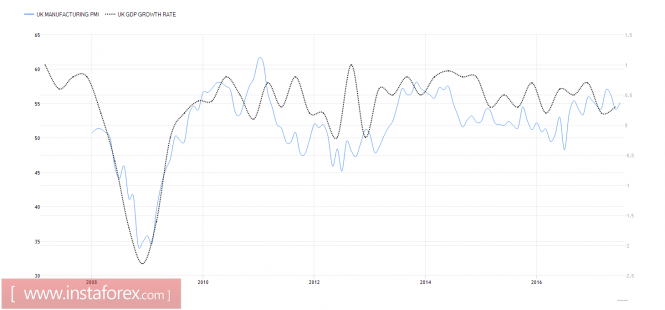

Dynamics of business activity and GDP of Britain

Source: Trading Economics.

Investors are accustomed to using the principle of "buy the rumor, sell the fact", a difficult October for the Sterling could lead to a decline in its rate in September. In the middle of autumn, a conference of the Conservative Party is scheduled where a decision will be made concerning doubts on Theresa May in reviving political risks for the pound. After that, the EU summit will be held, as the slow negotiations on Brexit will be discussed.

In connection with these events, a number of banks predicted that the EUR/GBP pair will be able to achieve parity before the end of the year. However, the ING Group is confident that this will not happen. The Bank of England is discontented with the increase of inflation under the influence of the sterling devaluation, hence, will continue to intrigue about raising the REPO rate, which will support the GBP/USD bulls.

Take note that in September, the clouds will thicken over the dollar linked with the discussion of issues related to the ceiling of the national debt. A number of senators might say that the risks of keeping the debt at the same level which is at the technical default zero, and the 100% certainty of success by Finance Minister Steve Mnuchin will allow investors to remember 2013 perfectly. Then, the government's cutoff led to a slowdown in the economic growth and dealt a blow to the US currency.

Technically, the GBP/USD pair has entered a significant area in the form of the intersection of long-term downward and medium-term upward trading channels. If the "bulls" manage to develop a correction within the framework of the transformation of the pattern "Shark" at 5-0, then the growth of prices in the direction of 1.302 and 1.308 is not ruled out.

GBP/USD Daily Chart