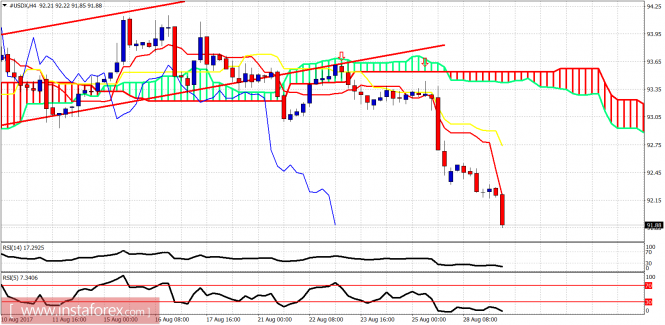

The Dollar as expected is heading towards 91.60 which was our target for the last couple of weeks. We posted an analysis right on time when the bullish channel and the consolidation were broken downwards and a new sell signal was given. Since then we target 91.60.

Red lines - bearish channel

Purple lines - expanding triangle pattern

The Dollar index remains in a bearish trend confirmed once the weekly candles broke below the weekly Kumo. The price has now broken below the 200 MA and is heading towards the lower boundary of the expanding triangle pattern. This target is around 90.70-90, depending on the time it will take to move towards the purple line. Once we get there, we see how strong of a support and pattern this will be. Weekly resistance is at 93.50. Breaking above it will start a strong bounce that could push the index back towards 95-96.

The material has been provided by InstaForex Company - www.instaforex.com