Leaving the shadow of geopolitical risks and the growing US dollar has forced investors to turn their backs on gold. According to TD Securities, in order to continue the rally above $ 1,300 an ounce, it is necessary to see a revival of the conflict on the Korean Peninsula as well as low inflation in the U.S. In this case, the precious metal would be able to rise around $1375. On the other hand, the absence of such drivers would increase the risk of a return of the prices towards the direction of $1200 per ounce.

Pyongyang's intentions to attack Guam became far from the only factor in the XAU/USD rally. Investors shifted to concerns of some Fed representatives on the slowdown of inflation, which puts the sticks in the wheel of the process of normalizing monetary policy. As a result, the inability of July consumer prices to reach the median forecast of Bloomberg experts (1.7%) has reduced the chances of a monetary restriction in December to 36%, which is a bullish factor for gold. Unfortunately, the success of precious metals on this matter is over.

President of the Federal Reserve Bank of New York, William Dudley is ready to vote for a rate hike in 2017, given that the new macroeconomic data will match his expectations. In this respect, the fastest growth in retail sales in July (+ 0.6% m/m) made the leading indicator from the Atlanta Federal Reserve Bank to raise GDP growth estimates in the third quarter to 3.7% q/q, which favorably affected the trading instruments market. CME futures raised the likelihood for a December rate hike by the Fed to 53%, which deprived the precious metal of the ground beneath.

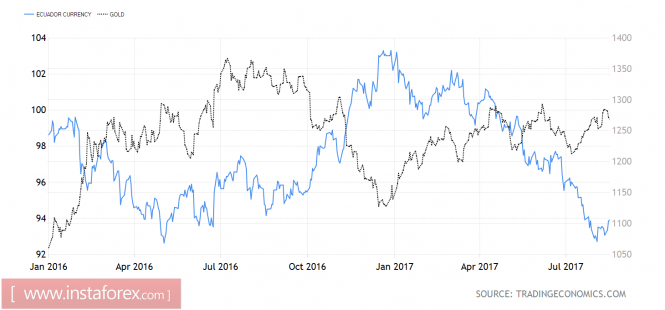

Strong data, the growth of the Citigroup U.S. Economic Surprise Index, as well as the "hawkish" rhetoric of Federal Reserve representatives extends a helping hand to the US dollar. In this context, the reverse correlation of gold with the USD index has become a strong argument in favor of selling.

Dynamics of the USD and gold index

Source: Trading Economics.

The fact that during the second quarter the inflow of capital into SPDR Gold Shares amounted to about $870 million does not particularly help the bulls in XAU/USD. The assets of the fund have grown to $34 billion. However, their dynamics in August was behind the prices, which is a confirmation of the speculative nature of the rally.

Pressure on gold could increase if at the meeting of the heads of central banks in Jackson Hole on August, regulators will provide preference to the same rhetoric that was made at a similar conference in Sintra, Portugal back in the end of June. Back then, expectations of the normalization of monetary policy have inflated debt market rates around the world, which has dealt a serious blow to the positions of XAU/USD bulls. Nevertheless, in July, investors realized that the process of monetary tightening will likely be slow, which raised the volume of bonds with negative yield to $8.6 trillion (+ 25% m/m) and allowed gold to grope for the bottom.

Technically, the inability of bulls to return prices to the levels of the previous ascending channel indicates their weakness. If the "bears" manage to overcome support at $1,250 per ounce, activating the "Shark" pattern will raise the risk of continuing the descending trend.

Gold, daily chart