After a long impulsive non-volatile bullish trend NZD/USD has recently countered with bearish impulsive pressure after bouncing off the 0.7550 resistance level. Due to decreased in Inflation Expectations report of NZD published this week at 2.1% which previously was at 2.2%, the currency has lost its grounds significantly which gained further momentum yesterday after NZD Official Cash Rate was unchanged at 1.75% which was quite against the current market sentiment of the global economic boom. RBNZ Monetary Policy Statement was also dovish in nature which leads to further weakness of the currency against USD recently. On the USD side, recently PPI report was published negative at -0.1% which was expected to be unchanged 0.1% and Unemployment Claims report was published with an increased figure at 244k from the previous value of 241k which was expected to decrease to 240k, which could not quite affect the gains of USD against NZD Yesterday. Today USD CPI report is going to be published which is expected to show a rise to 0.2% from the previous value of 0.0% and Core CPI report is expected to increase to 0.2% from the previous value of 0.1%. To sum up, NZD is currently quite bearish in nature which is expected to continue further as of the Inflation and Rate hike decisions could not prove to show some gains for the currency against USD whereas USD recent economic reports were hawkish in nature to back up the USD gains.

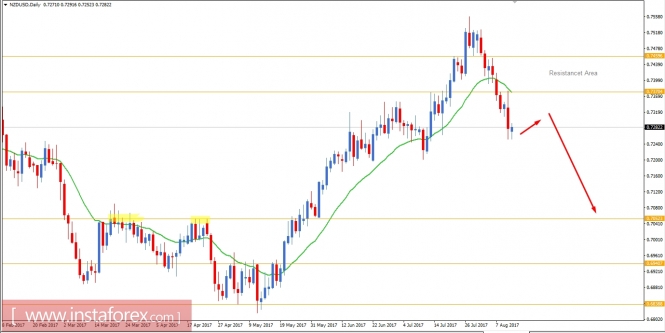

Now let us look at the technical view, the price is currently residing below the resistance area of 0.7370 to 0.7460 which indicates further bearish pressure in this pair with a target towards 0.7050 but we can see some correction along the way before the price proceeds with its impulsive bearish move. The pair has recently retested the 0.7370 resistance level and dynamic level 20 EMA before showing some bearish impulsive move. As the price remains below the 0.7370-0.7460 resistance area the bearish bias is expected to continue further in the coming days.