Eurozone

The strong report on the US labor market for July led to a reassessment of the euro's outlook for the development of rising dynamics.

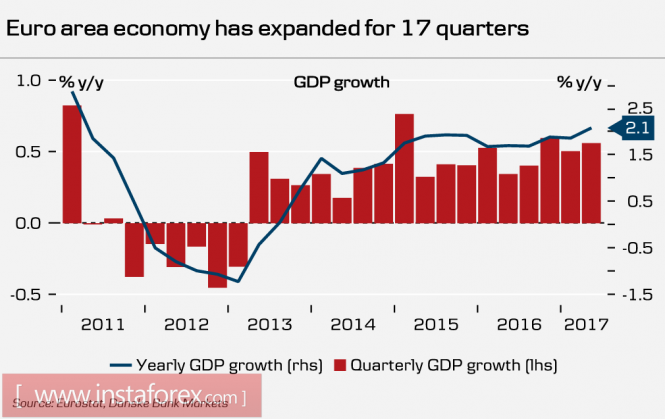

The European economy grew for 17 consecutive quarters, the annual growth rate has reached 2.1%, which is the strongest indicator since 2011. The inflation rate has declined to a minimum since June 2009, core inflation remains at a high level, despite some downfall.

Prior to the next meeting of the ECB, which will be held on September 7, and exactly one month from now.

In favor of a deeper correction, the technical signals but fundamentally a reversal in the mood of investors has not yet been observed.

Today, the data on German industrial production in June and Sentix investor in the euro zone for August will be published today, despite a slight decrease in the last month, it is at the highest levels since 2007. Business activity is at high-level .

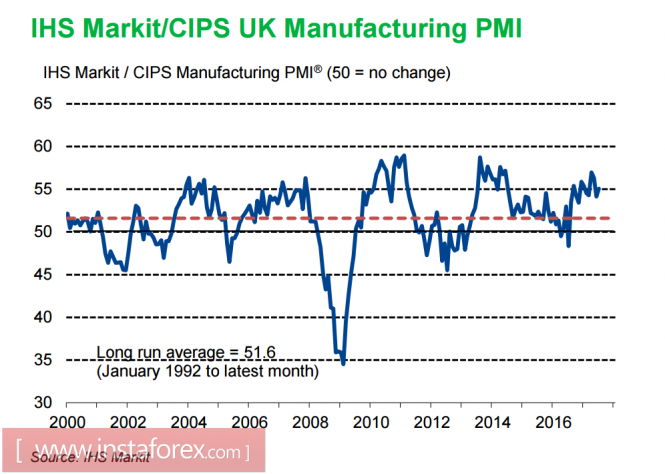

United Kingdom

The pound was declined in large part.

At the same time, expecting a reversal in the pound is too soon.

Oil and ruble

Brent attempts to gain a foothold above $52/bbl, using a successfully developing conjuncture, but there is no assurance for continuous growth. Commercial oil reserves in the United States had slightly declined but was able to remain at a high level. Production has increased to 9.43 million barrels, and with this, the bulls can not expect support.

The OPEC countries are desperately trying to regain control of the situation. As the problems in Venezuela could possibly lead to a reduction in production, OPEC + is forced to look for a solution to outstrip production growth in Libya and Nigeria, which in the end does not give hints about the potential reduction in global reserves.

Baker Hughes issued a report regarding the stabilization of a number of active drilling rigs at 765 units while the growth had stopped, this is a positive factor for the bulls. The positive CFTC report on Friday indicates an increase in the aggregate speculative position. Given the renewed demand for commodity currencies, it is assumed that oil will still make an attempt to increase to $55/bbl.

The ruble continues to trade in the range with no reactions either to the dynamics of oil prices or to the expansion of sanctions by the United States. According to the Federal Customs Service, the Russian Federation's revenues from oil exports in the first half of 2017 gained 38.7% which is higher than the results during the first half of 2016, revenues from gas exports increased by 19.5%. The confident growth of industrial production for four consecutive months enable the ruble to feel confident, even despite a decrease in purchases by the Ministry of Finance of foreign currency.

This week, the ruble may resume strengthening.

The material has been provided by InstaForex Company - www.instaforex.com