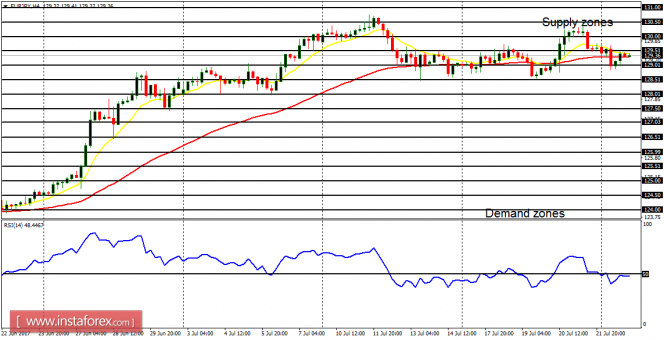

EUR/USD: This is a bull market, although the price merely went sideways on July 24. The price is currently between the support line at 1.1650 and the resistance line at 1.1700. The resistance line at 1.1700 is the next target for today and tomorrow. Once it is breached to the upside, there is another target at the resistance line at 1.1800.

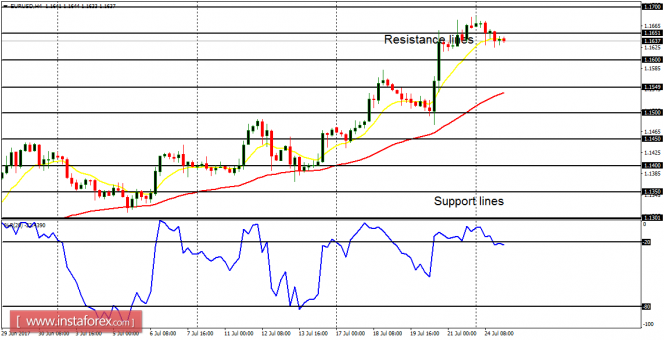

USD/CHF: The USD/CHF did nothing significant on Monday. The price moved sideways in the context of a downtrend, and the downtrend is supposed to continue as price goes towards the support lines at 0.9450, and 0.9400. On the other hand, there could be a reversal of the trend when USD gains stamina.

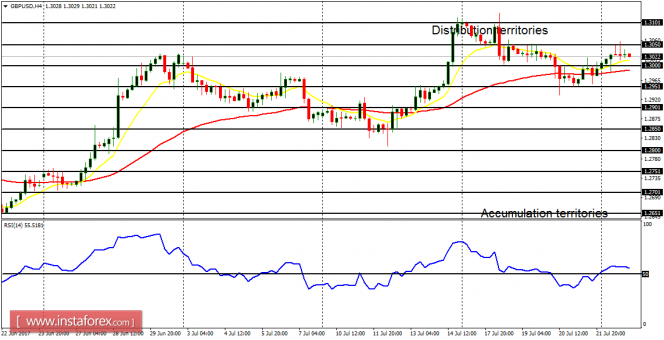

GBP/USD: The Cable is neutral in the short-term, and bullish in the long-term. A movement above the distribution territory at 1.3150 would strengthen the recent bullish bias; a movement below the accumulation territory at 1.2800 would result in a bearish bias. The further sideways movement would bring more consolidation.

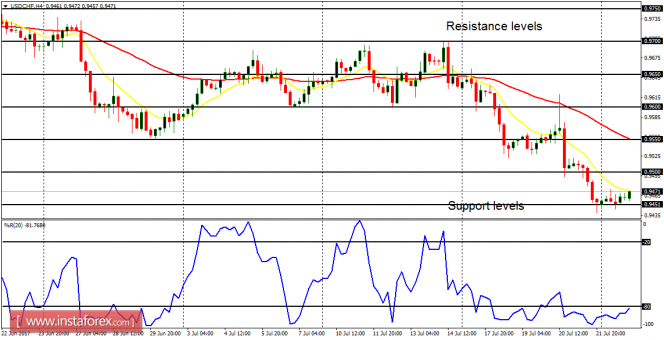

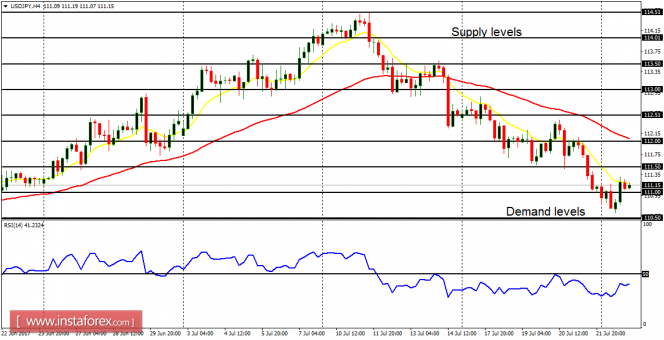

USD/JPY: There has been a slight upwards movement on this pair, which is essentially in the context of a downtrend. This can end up being opportunities to sell short at a better price, for the Bearish Confirmation Pattern in the market is intact, and the outlook on JPY pairs is bearish for the rest of the month.

EUR/JPY: This cross has held out its bullishness so far, in spite of the short-term consolidation being witnessed. One reason the cross is able to remain bullish till now is the strength in the EUR itself, and things would begin to drop once the EUR loses strength. There is a possibility of a bearish reversal before the end of the month.