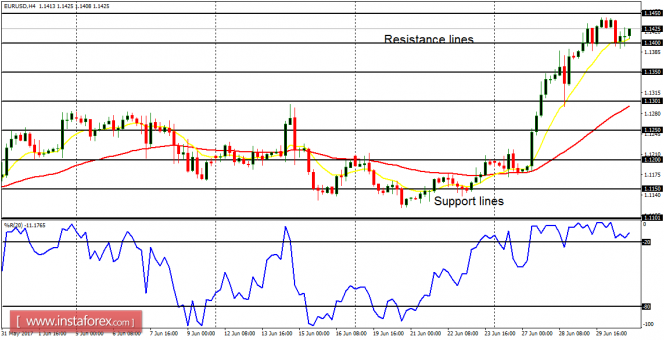

EUR/USD: This pair moved upwards by 230 pips last week, ending the consolidation phase that was witnessed from June 12 to June 24. There is a huge Bullish Confirmation Pattern in the market, and further upwards movement is possible. However, the upwards movement may not take place protractedly because the outlook on EUR pairs is bearish for this week. The EUR/USD may thus slide southwards before the end of the week.

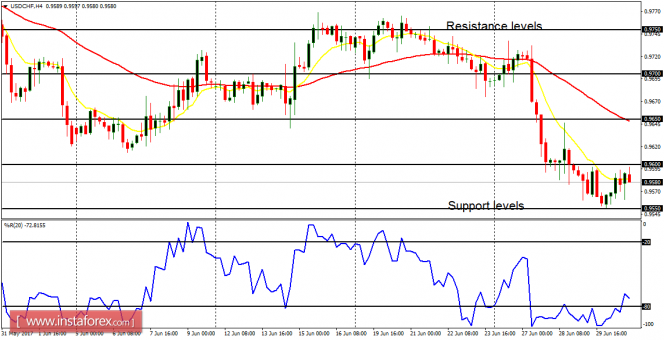

USD/CHF: The USD/CHF pair dropped precipitously last week, losing about 160 pips. Price almost tested the support level at 0.9550, before bouncing upwards to close near the resistance level at 0.9600. There is a bearish bias on the market, though that may change soon as EUR/USD slides southwards, helping USD/CHF to rally.

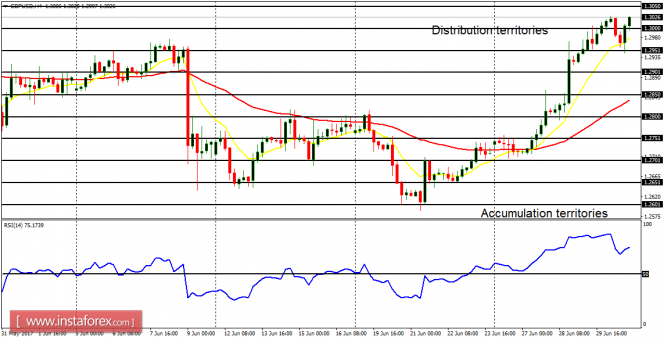

GBP/USD: The GBP/USD pair gained about 340 pips last week, closing above the accumulation territory at 1.3000 (which was our target for last week). It is possible that price would continue going upwards this week, but the upwards movement would not be strong, owing to a bearish outlook on GBP pairs for this week and for the month of July 2017.

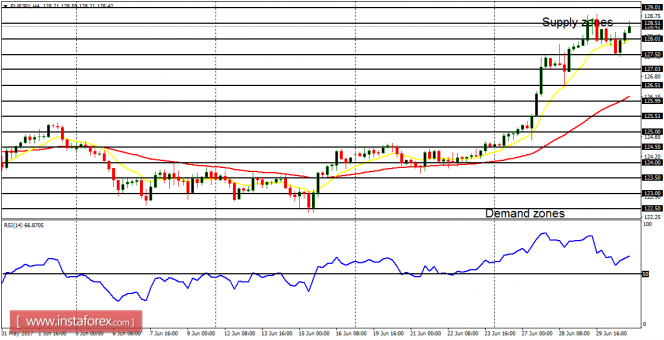

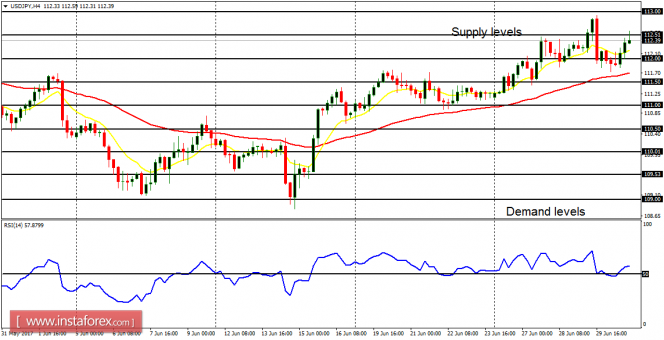

USD/JPY: Since June 14, this currency trading instrument has been going upwards slowly and gradually, gaining about 350 pips since then. The supply level at 112.50 was tested but price could not close above that level. This week, there is a great possibility of a bearish run, because the outlook on JPY pairs is seriously bearish for this week and for July 2017.

EUR/JPY: Unlike its USD/JPY counterpart, which moved upwards slowly and gradually, the EUR/JPY pair moved upwards significantly and rapidly. Price took off from the demand zone at 124.50, reaching the supply zone at 128.50 (a movement of 400 pips). Short trades are not currently advised here, owing to a big Bullish Confirmation Pattern in the market. Nonetheless, there would soon be a deep correction in the market as a result of the bearish outlook on JPY pairs for July – and that is when short trades would make some sense.