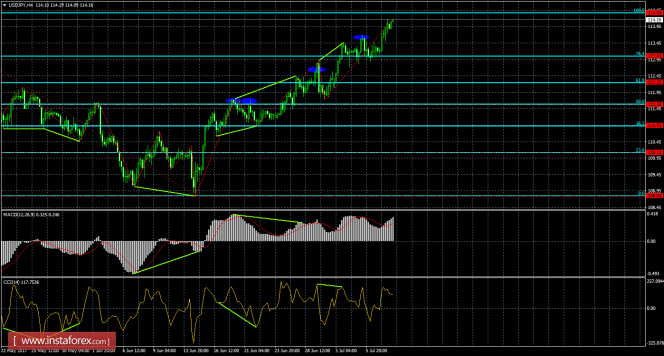

4h

The pair USD / JPY on the 4-hour chart continues the growth process towards the Fibo level of 100.0% - 114.36 on the new Fibo-levels grid. The retracement of the pair on July 10 from the correction level of 100.0% will allow traders to expect a reversal in favor of the Japanese currency and a slight drop towards the correctional level of 76.4% - 113.04. Maturing divergences are not visible in any indicator. Fixing the quotes above the Fibo level of 100.0% will increase the pair's chances for further growth towards the next corrective level of 161.8% - 117.76.

Daily

On the 24-hour chart, the pair completed the growth to the correction level of 23.6% - 114.07. There are no maturing divergences in any indicator. The fall of the pair's rate from the Fibo level of 23.6% will allow us to count on a reversal in favor of the Japanese yen and a slight drop towards the corrective level of 38.2% - 111.17. Fixing the quotes above the Fibo level of 23.6% will increase the probability of continued growth of the pair towards the next correction level of 0.0% - 118.66.

The material has been provided by InstaForex Company - www.instaforex.com