Trading plan for 29/06/2017:

The US Dollar is still weak across the board, although changes do not belong to the largest. GBP and EUR are the strongest currencies from the G10 thanks to Draghi and Carney's comments yesterday. EUR/ USD attacks 1.14 and GBP/USD is at 1.2960. WTI oil has broken above important resistance and is approaching $45.00. Among the precious metals, the strongest is the palladium which has grown 0.6 percent. The gold ounce is trading at $1 253.

On Thursday 29th of June, the event calendar is light in important economic releases, but market participants will pay attention to Mortgage Approvals data from the UK, CPI data from Germany, and Unemployment Claims and Final GDP data from the US.

EUR/USD analysis for 29/06/2017:

The CPI data from Germany are scheduled for release at 12:00 pm GMT and market participants expect a slight increase in inflation, from -0.2% to 0.0% on a monthly basis. Nevertheless, on a yearly basis, the inflation is expected to drop from 1.5% to 1.4%. The CPI is the headline inflation figure that indicates the strength of domestic inflationary pressures. Despite the optimistic statements from the ECB, the indicator remains below the ECB target projections of 2.0%. The inflation growth will influence the EUR/USD pair and related crosses to move higher as the market is likely to intensify expectations for incoming change in ECB monetary policy. Yesterday's Mario Draghi remarks at the conference in Portugal are the best example of the current market sentiment towards the stronger Euro.

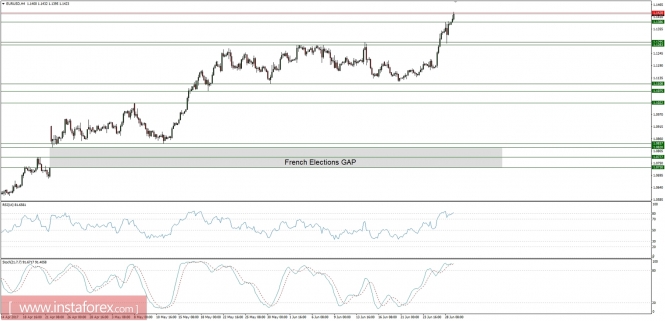

Let's now take a look at the EUR/USD technical picture on the H4 time frame. The market broke above the 1.1400 level with a new high at the level of 1.1426 at the time of writing. Nevertheless, the whole move to is now overstretched and there is a visible bearish divergence between the price and both of the indicators, stoch, and RSI. The nearest technical support is at the level of 1.1386, but much more important technical support is at the level of 1.1283.

USD/JPY analysis for 29/06/2017:

The highly anticipated US Final GDP data is scheduled for release at 12:30 pm GMT and market participants expect the data to remain unchanged at the level of 1.2%. The impact on the financial markets will be bigger if the data are revised higher. Nevertheless, the prospects for improvement in Q2 remain intact. Monday's revised estimate of the Atlanta Fed's GDP model projects a 2.9% GDP increase, more than twice the gain in Q1. The Wall Street analysts are optimistic about Q2 GDP as the median forecast for Q2 GDP growth is 3.0%, according to CNBC latest survey. On the other hand, the International Monetary Fund has cut its US GDP forecast for 2017 to 2.1% from 2.3%.The main reason for the decrease is Trump's administration policy uncertainties. Clearly, we have two completely opposite points of view for the US GDP and it makes this data release even more interesting.

Let's now take a look at the USD/JPY technical picture on the H4 time frame. The price is still trading just below the 61%Fibo at the level of 112.23 and below the technical resistance at the level of 112.46. The odds for a further upside breakout are decreasing as there is a visible bearish divergence between the price and the momentum indicator. On the other hand, if the US data surprise global investors there will be still a chance for a quick rally to the level of 113.13. Otherwise, a corrective pullback towards the next technical support at the level of 110.81 is expected.